Interview with Doers Merchandising (part 2)

Key Strategies for New CPG Brands in Retail

In the second part of our interview with Brian Burkhart, founder of Doers Merchandising, we continue exploring actionable strategies for new CPG brands to break into retail. From ensuring planogram compliance to building strong relationships with retailers, Brian shares invaluable insights that can help brands thrive in this competitive space.

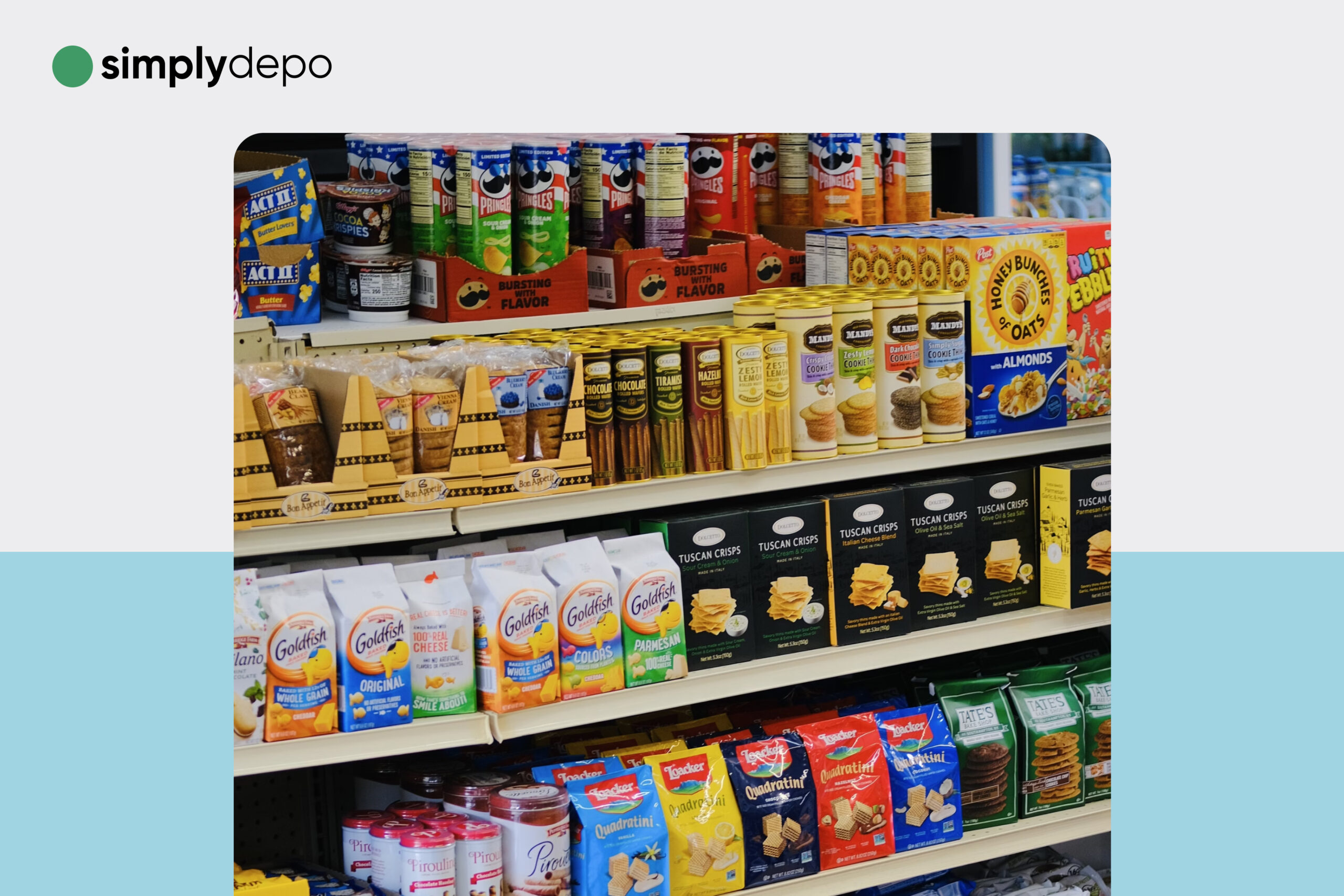

Key Merchandising Strategies for New CPG Brands

What key merchandising strategies should they prioritize for a new CPG brand aiming to enter retail?

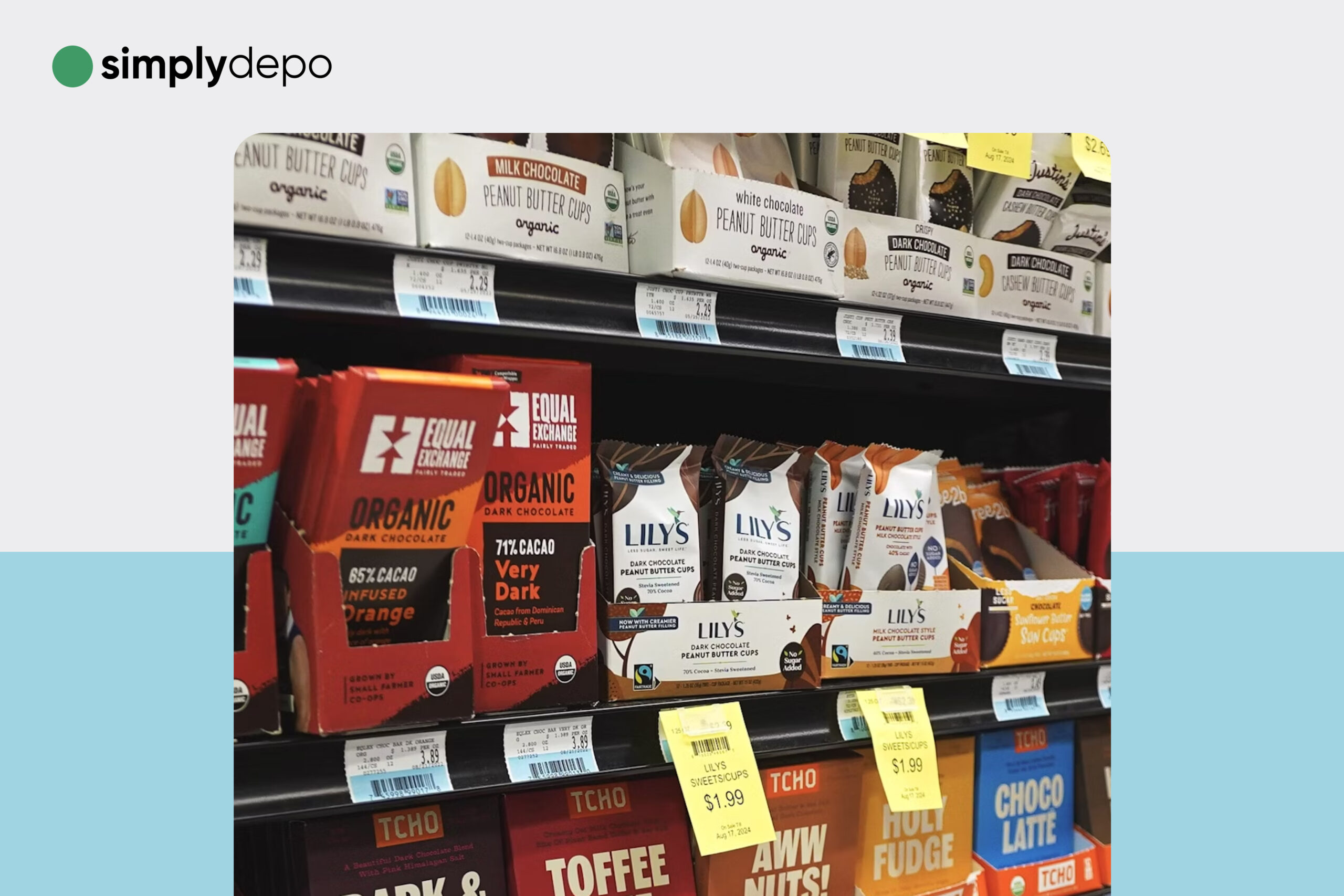

Brian: Planogram integrity is crucial. You deserve that space if you’re authorized to be in a store. Yet, it’s shocking how often I see brands losing shelf space to others. My first priority is ensuring that when I walk into a store, I check my placement—how do my products look, and are all SKUs in stock? If not, we’re fixing it on the spot.

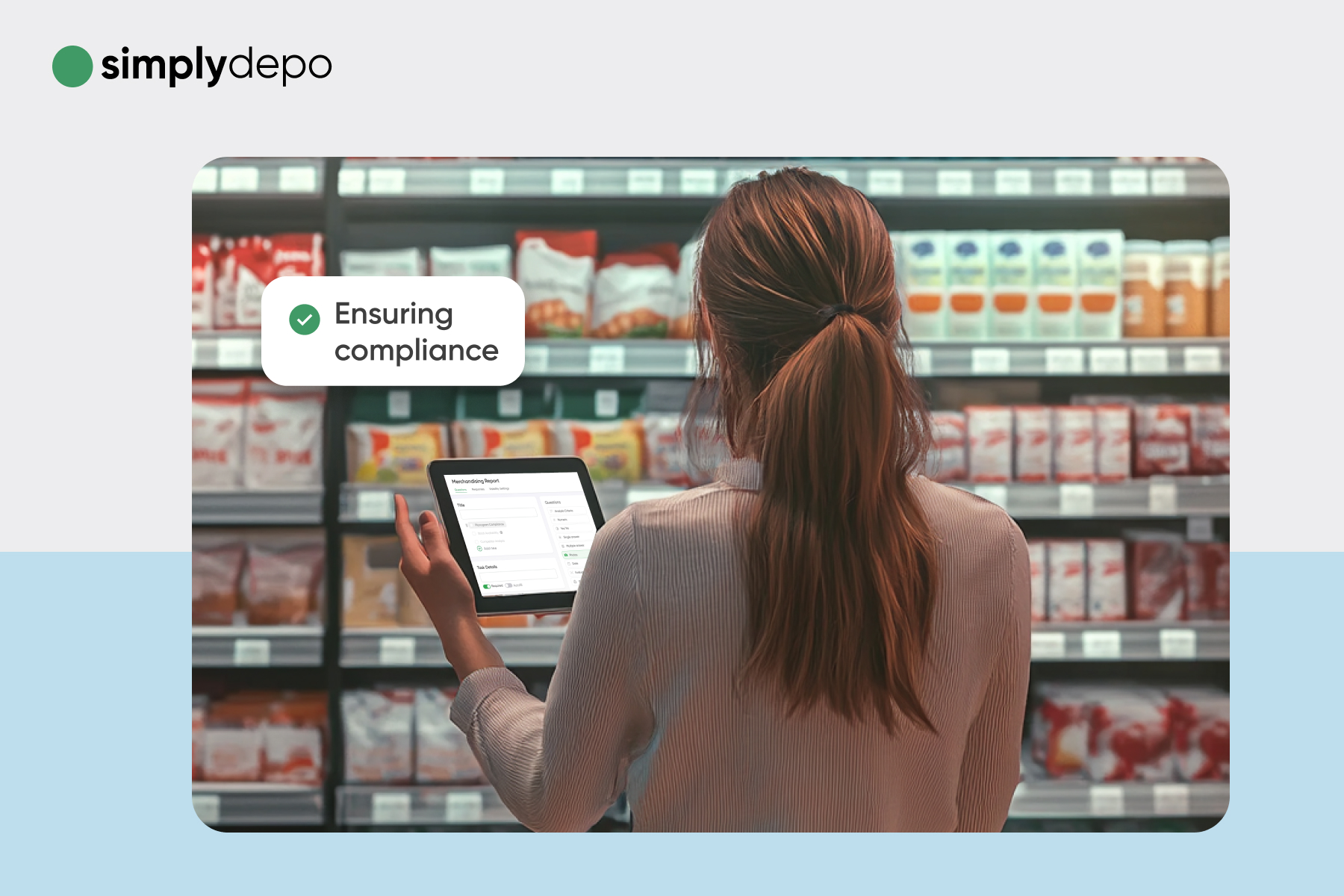

Ensuring Planogram Compliance

How do you make sure your planogram is being followed?

Brian: We have several ways. We get placement lists from brands showing where we’re supposed to be, and we use apps and store-specific tools to track data. But often, it’s as simple as showing up. You might discover that a product isn’t on the shelf, but it’s sitting in the back. We’ve had that happen with brands like Barcode. At Wegmans in Rochester, we moved their products from the back to the shelves, and the difference was immediate. Being present, ensuring products are sellable and visible, makes all the difference.

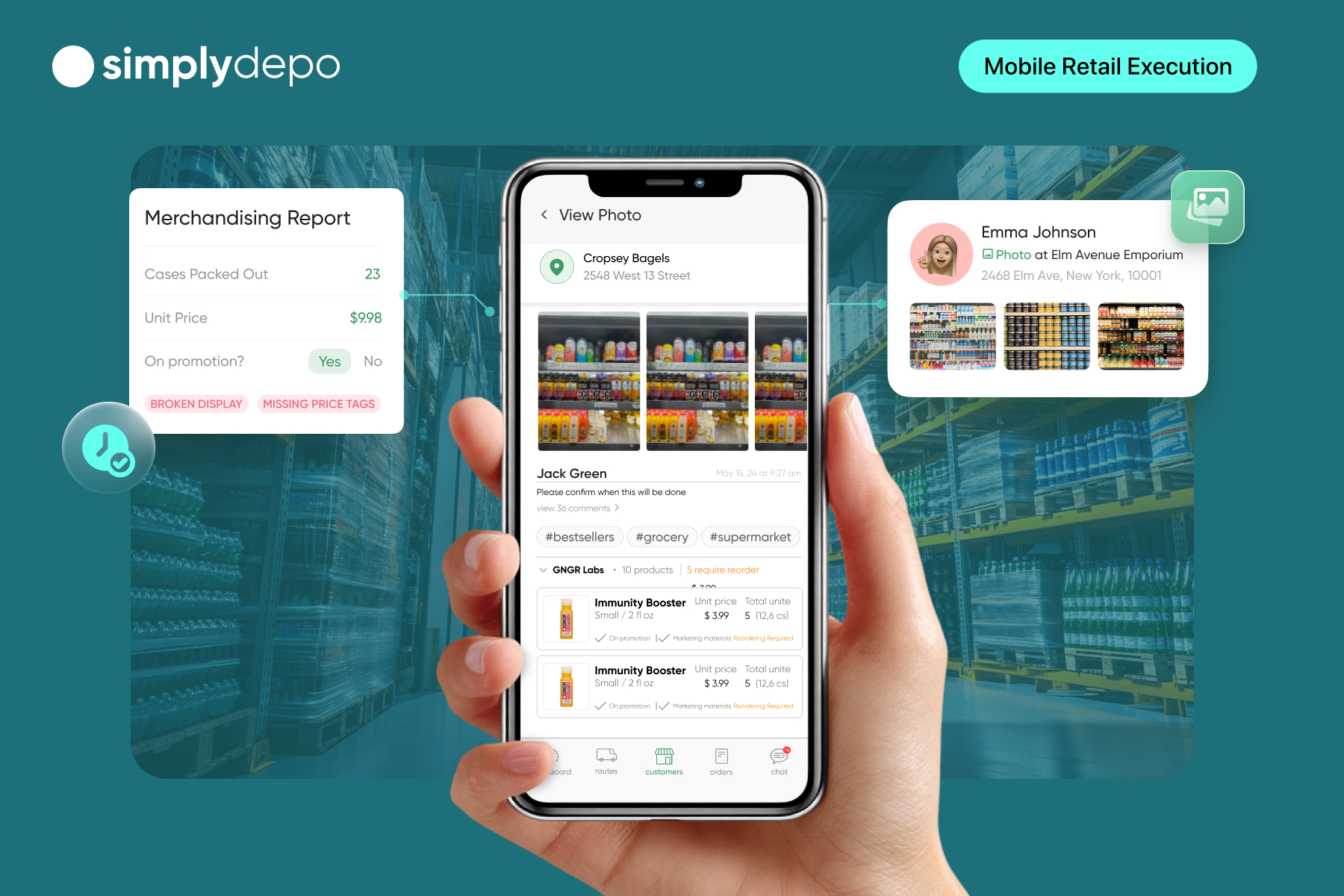

Tracking Results in the Field

How do you evaluate whether a strategy is working? How quickly can you see results?

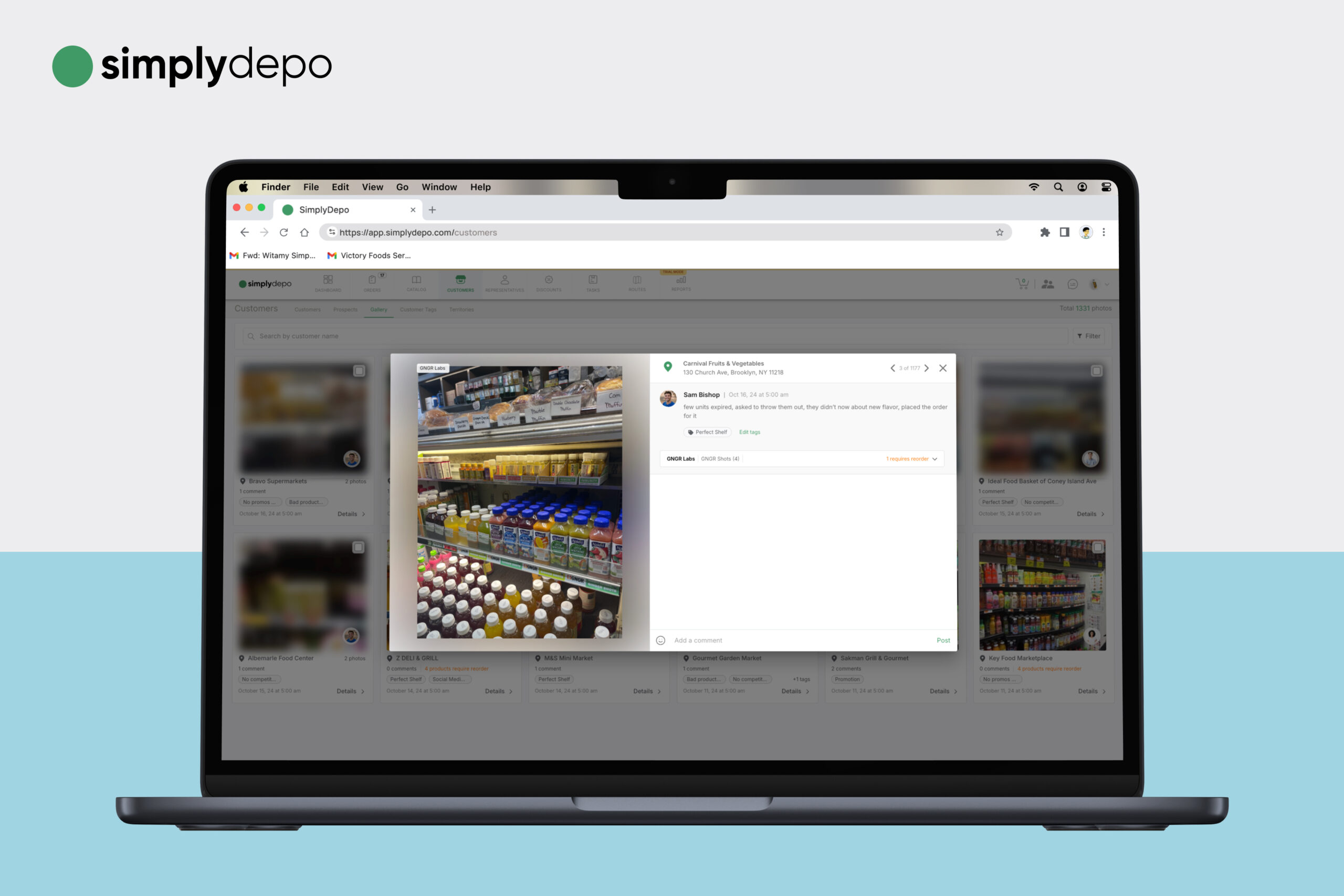

Brian: We track results using an app that lets us run detailed surveys. We compare before-and-after shelf conditions, pricing, competitor positioning, promotions, and more. A typical store visit takes about 30/60 minutes, depending on what needs to be done. Sometimes it’s quick; other times, we’re resolving inventory issues or pushing orders through. Ultimately, results depend on how often the brand wants us to visit—weekly, bi-weekly, or monthly.

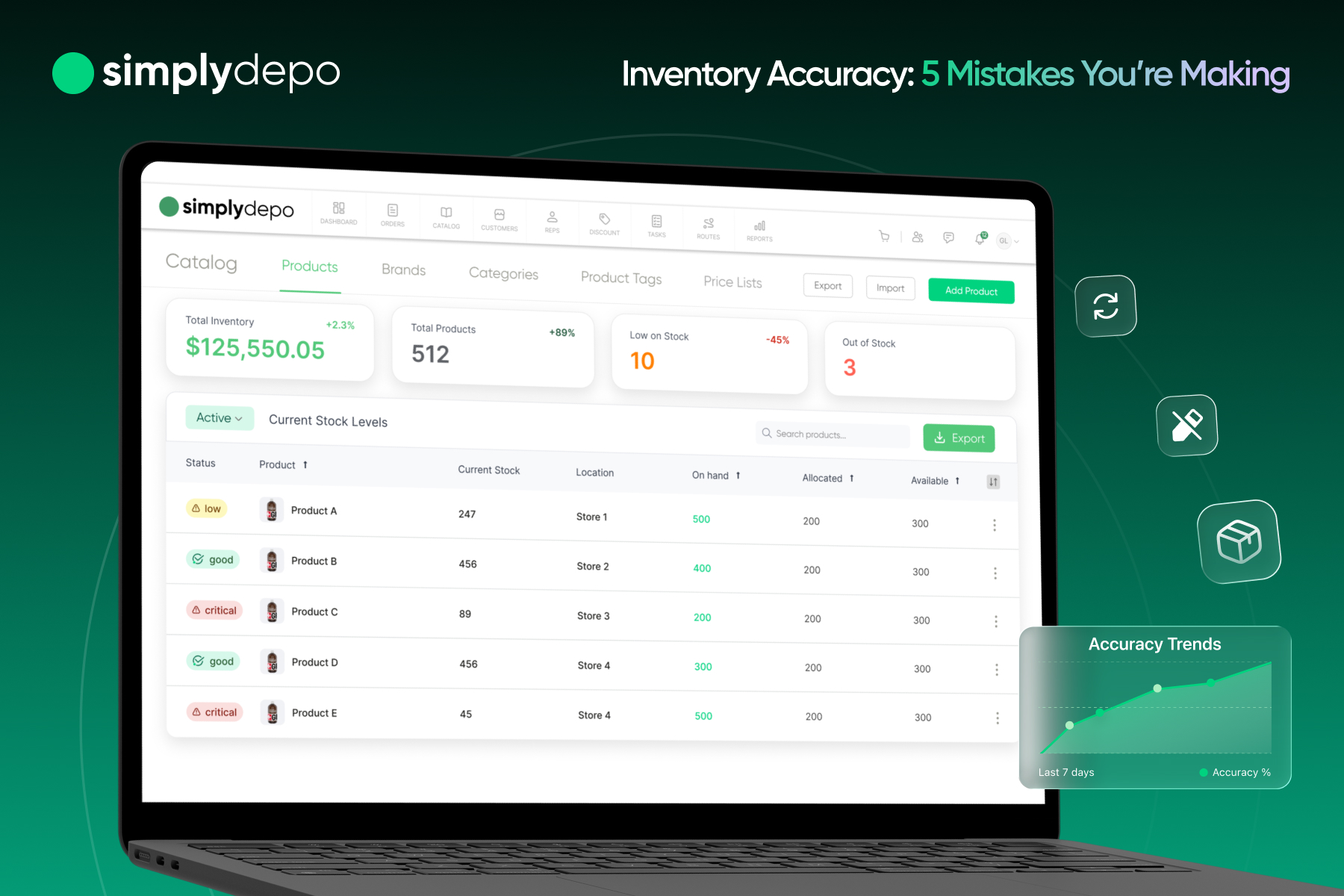

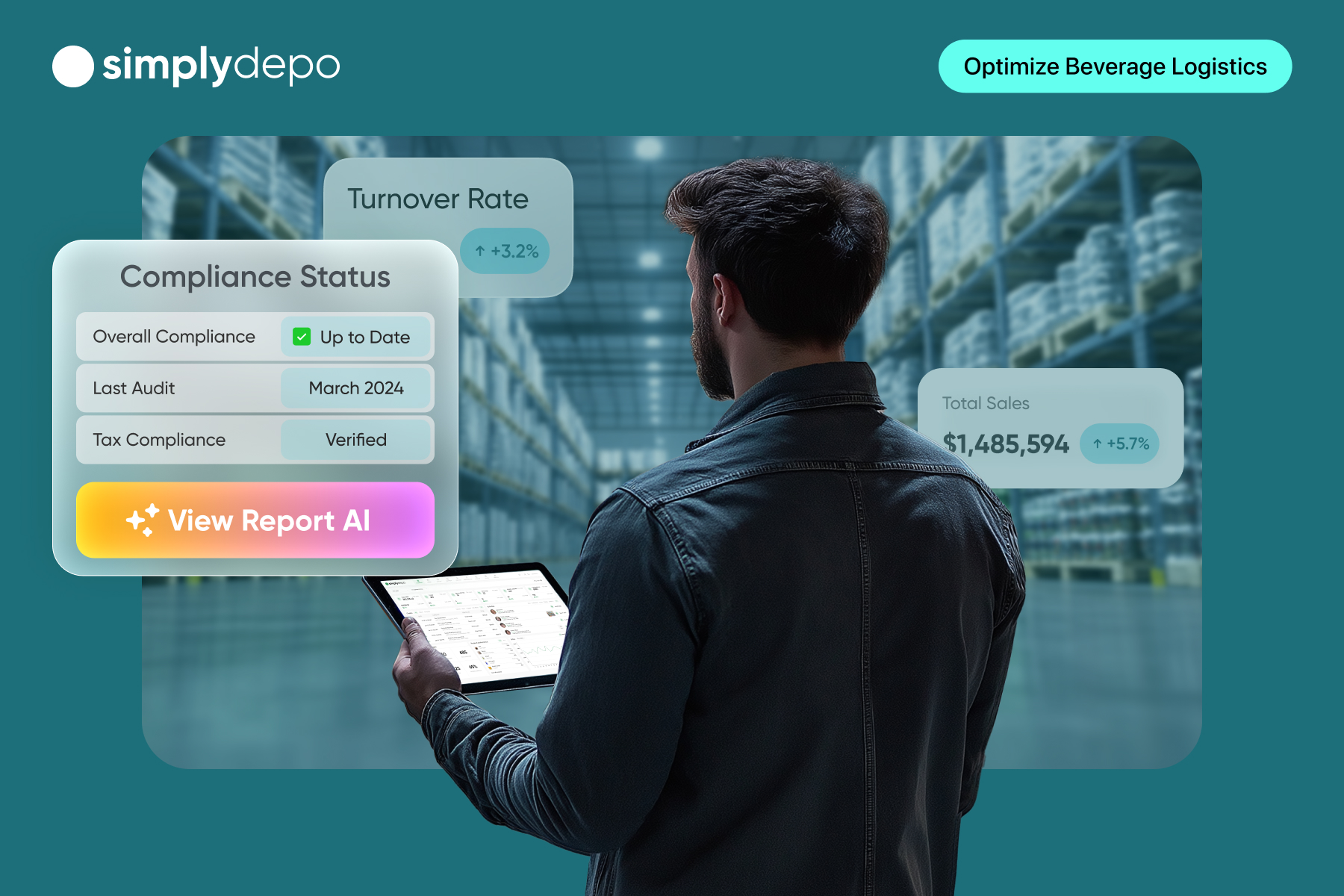

Leveraging Sales Data for Performance Insights

Do you get sales data from the brands to help track performance?

Brian: Yes, brands share sales reports with us. This is important because if sales dip, we need to figure out why. Is there a gap in delivery? Did the product not make it onto the shelf in time? I focus on the top-performing stores using the 80/20 rule—80% of sales often come from 20% of stores. By targeting high-volume stores, we can drive greater overall sales.

Doubling Sales Through Merchandising

Can you share an example of a brand that saw significant growth after starting with your services?

Brian: Definitely. We started working with a brand in March that had authorization for ShopRite but was struggling to expand into 39 additional stores. We helped them secure those new placements, doubling their sales within a few months. They also had a promotional program that wasn’t being executed fast enough, so we sped things up, putting displays in place within a week instead of the usual three. This quick action gave them an extra 2-3 weeks of sales from secondary orders, which had a big impact on their ROI.

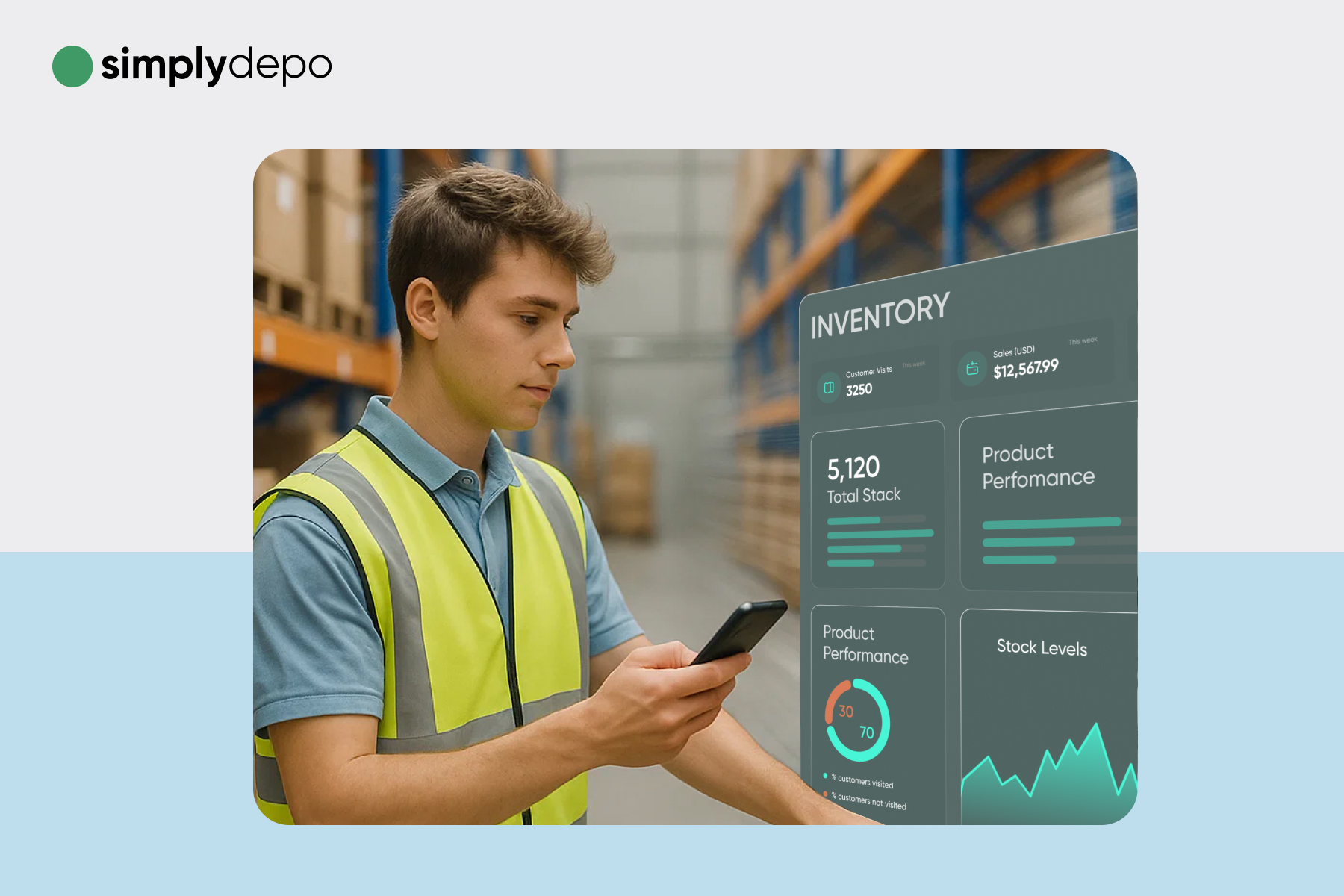

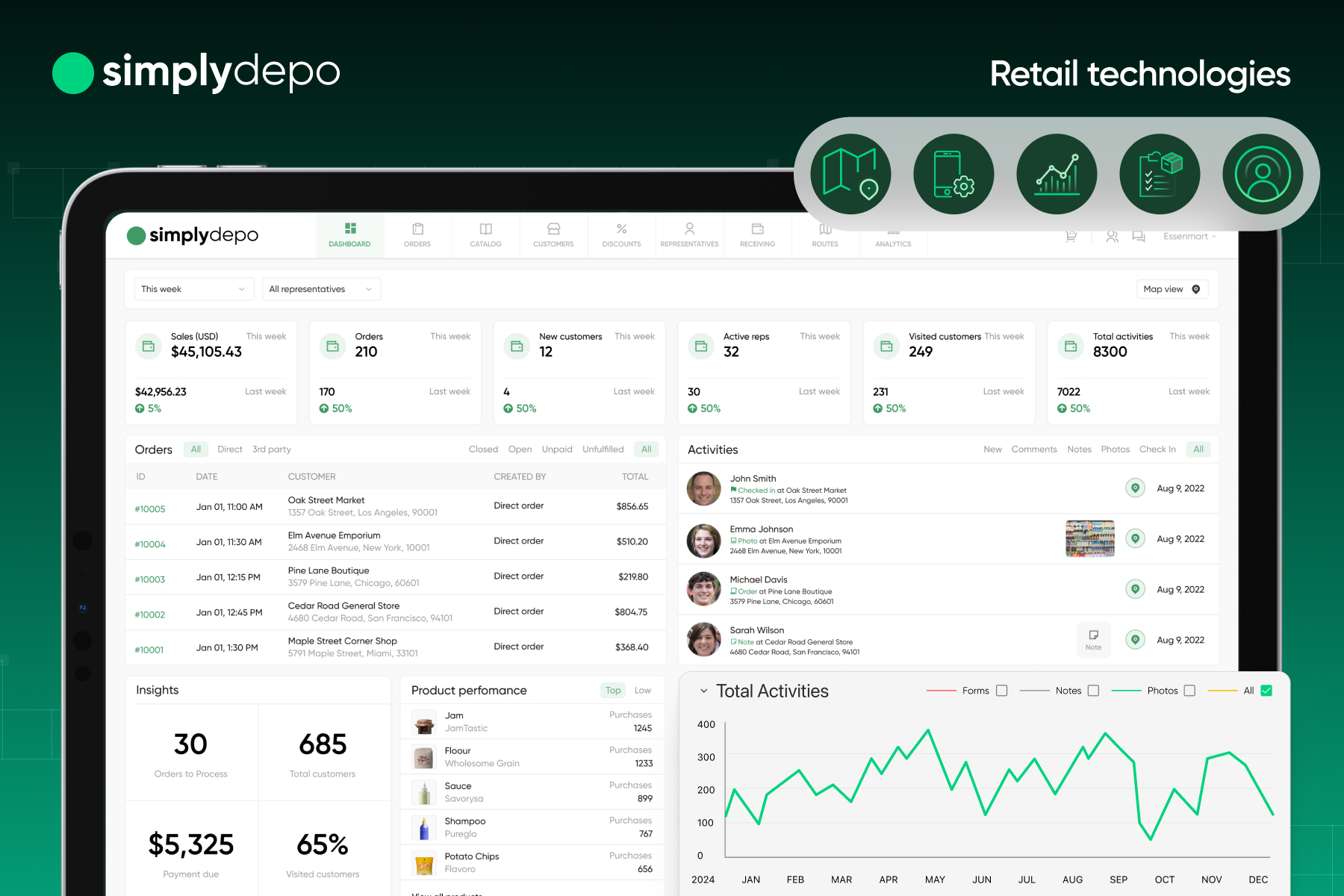

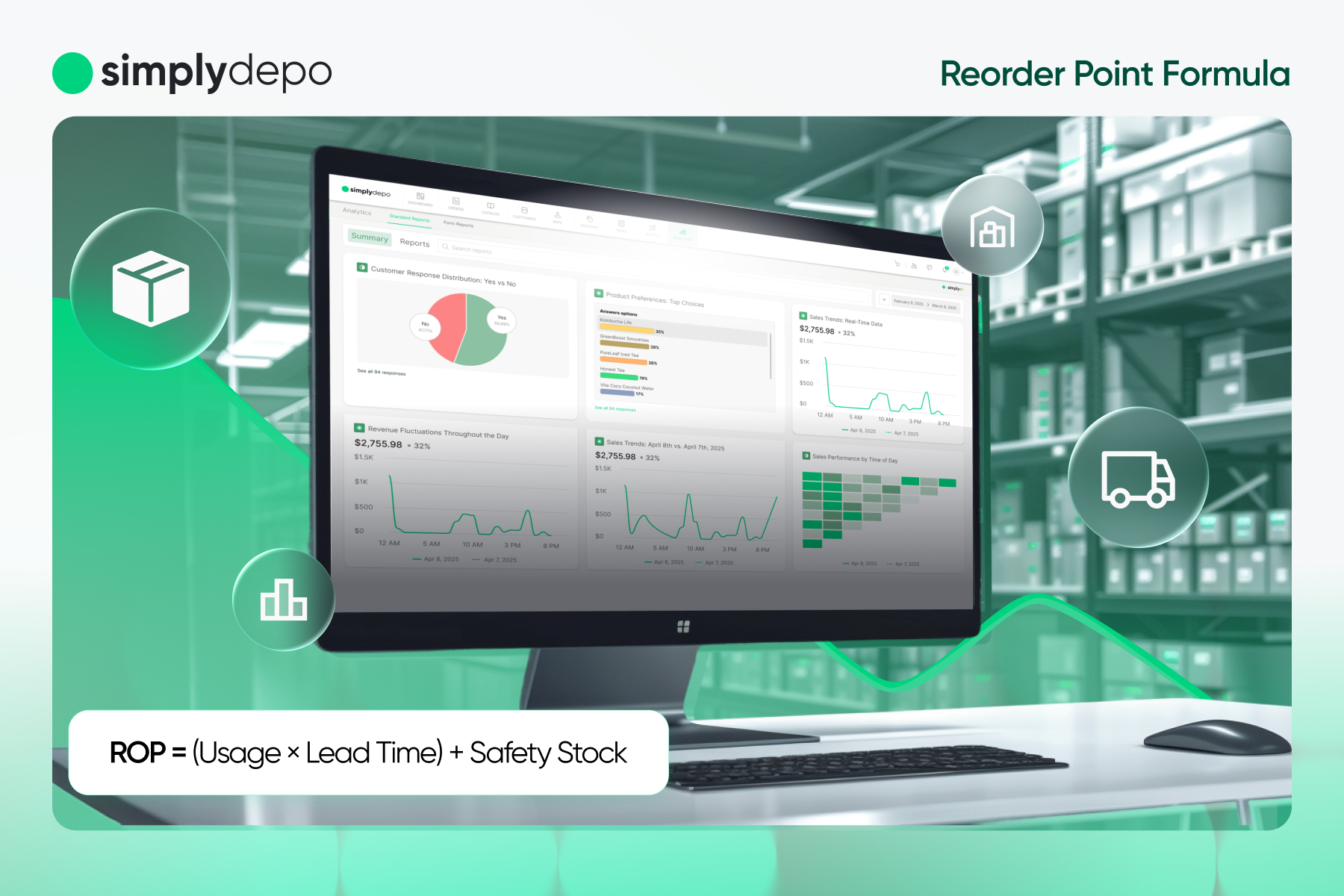

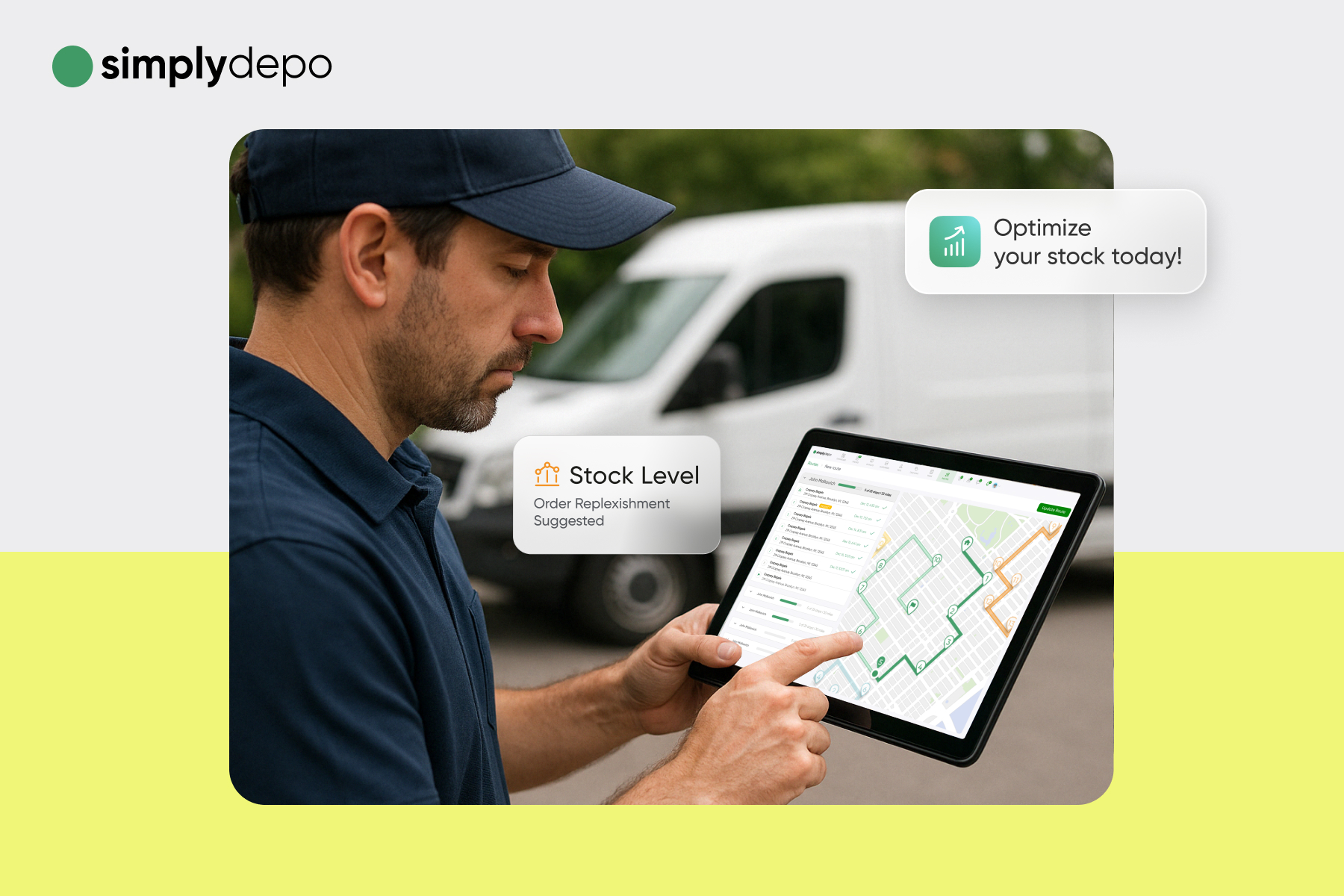

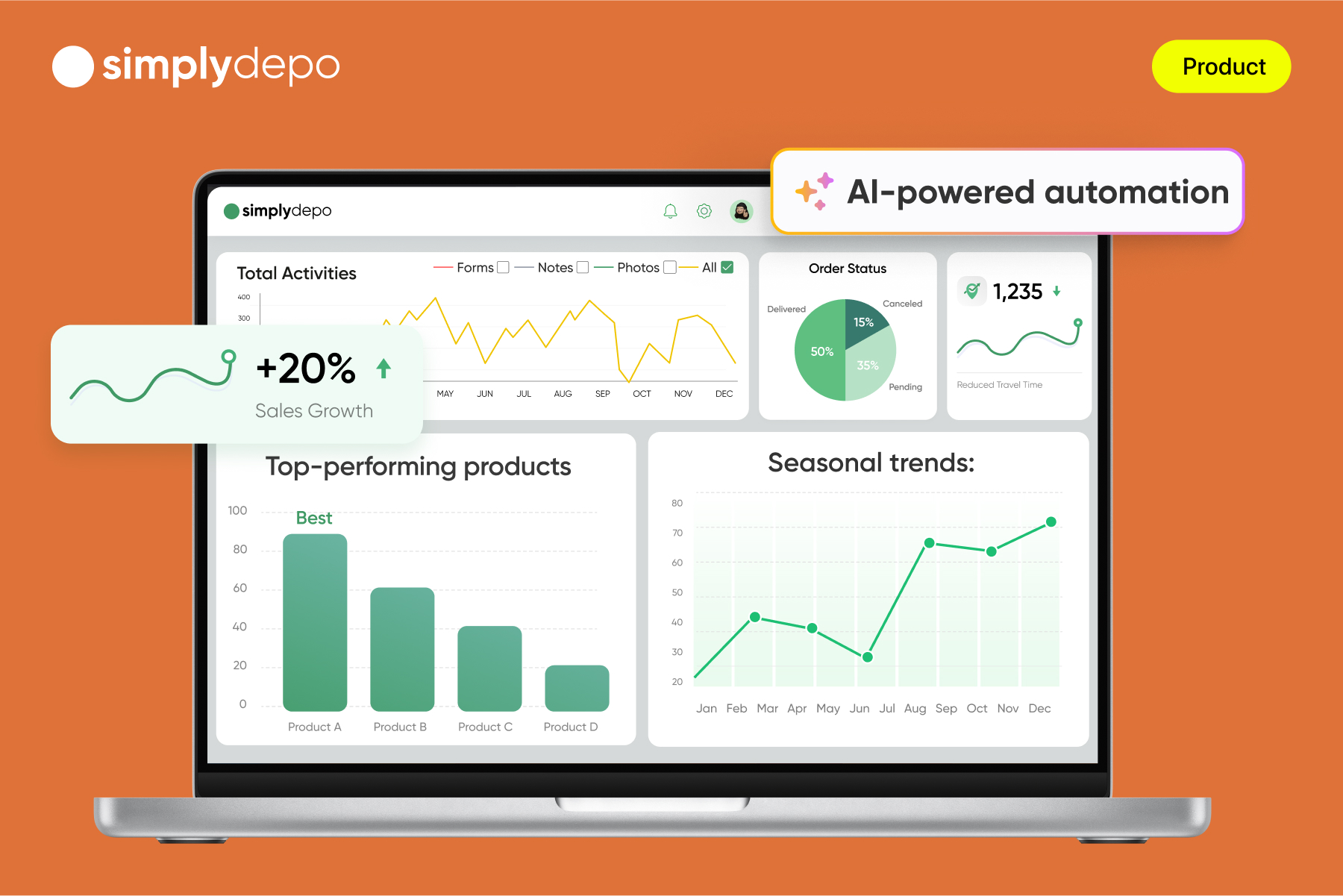

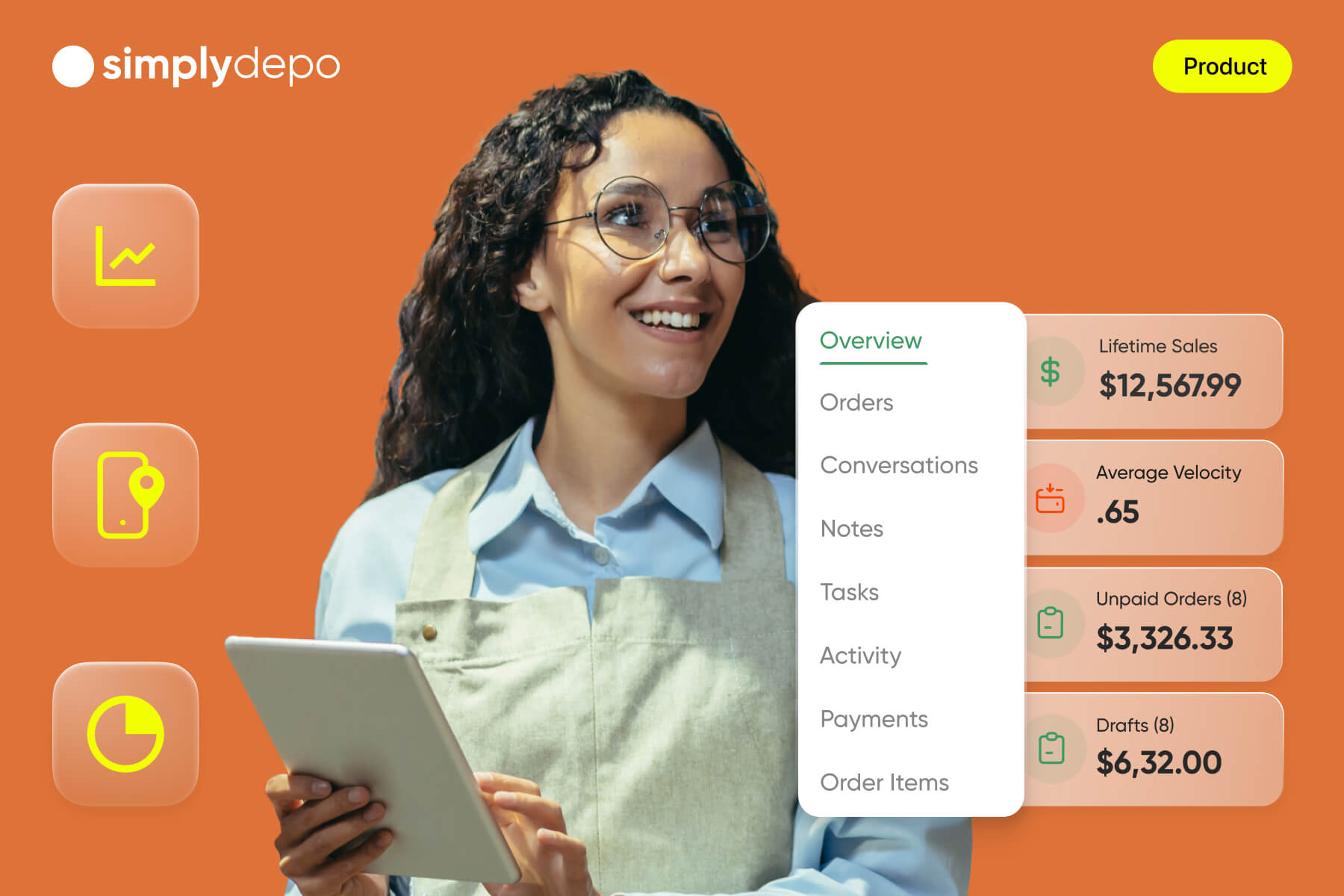

The Role of Technology in Merchandising

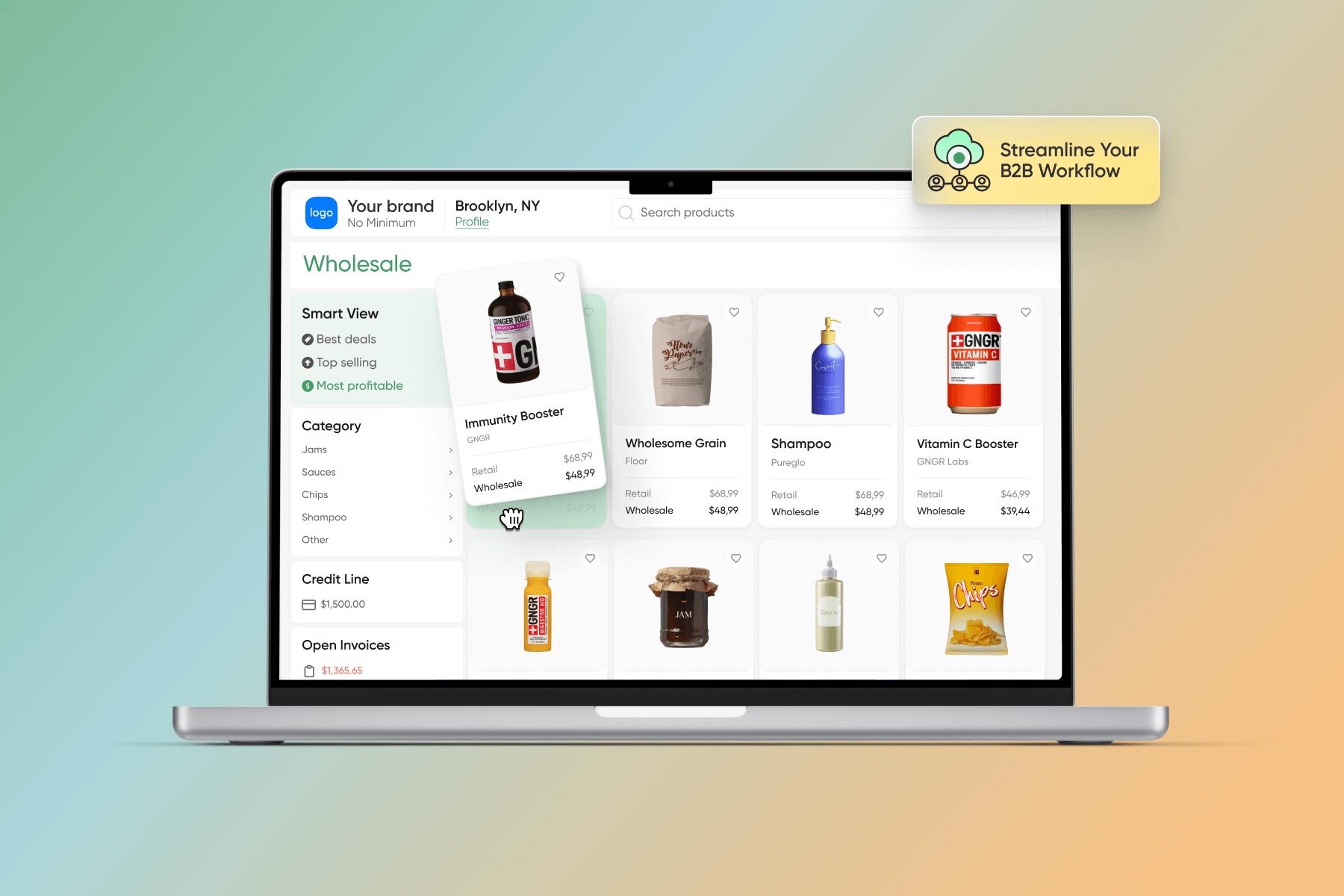

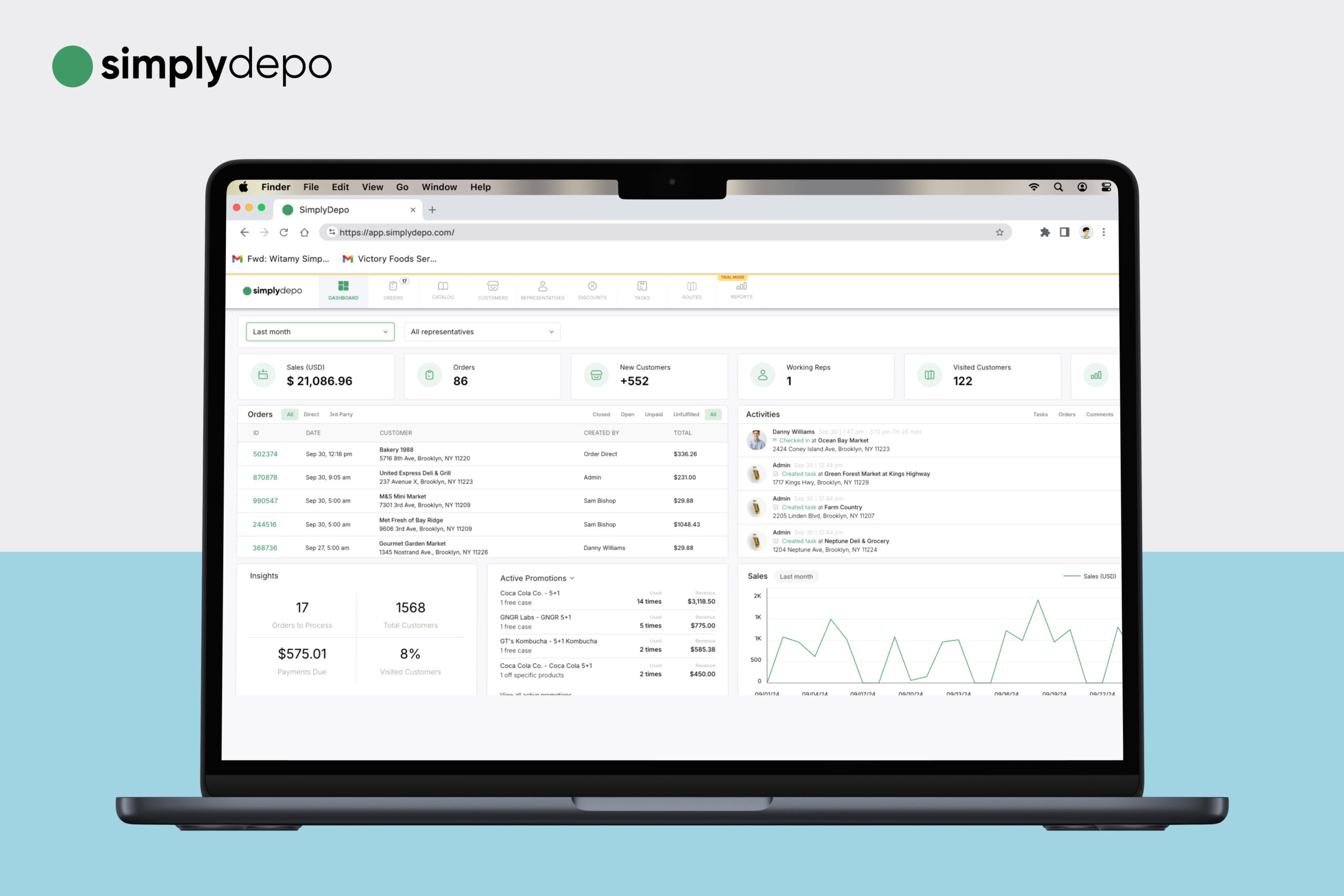

How do you see the role of technology in merchandising? Are tools like SimplyDepo making a difference?

Brian: I’ve used a lot of tools over the years. SimplyDepo is perfect for emerging brands building out their retail strategies because it’s an all-in-one solution. I’ve tried Salesforce, but it’s not user-friendly for merchandising. SimplyDepo is easier to navigate and gets the job done. I definitely recommend it for brands looking for an effective, straightforward tool.

Building Strong Relationships with Retailers

What advice would you give a new CPG brand for building strong relationships with retailers and distributors?

Brian: Show up, plain and simple. Consistency is key. Store managers need to know you’re present. I tell my team to be at the same stores, on the same day each week, so managers know they can count on us. Be visible, consistent, and don’t be a headache. That’s how you build trust.

Hiring the Right Merchandisers

What traits do you look for when hiring merchandisers for your team?

Brian: Work ethic, without a doubt. I’ve hired many people over the years, and it always comes down to the same few traits. Half of my current team consists of people I’ve worked with for 10-20 years because I trust them. On the flip side, I avoid those who see this as just a part-time gig. This job requires persistence, especially when you’re hearing “no” a lot. You need people who will keep going back and stay positive.

Maintaining Team Performance

How do you ensure your team meets your performance expectations?

Brian: I keep an eye on their visits and how they respond to survey questions. If someone stops leaving detailed comments or skips engaging with decision-makers, that’s a red flag. I also believe in coaching and recognition. Sometimes, your most successful employees can feel overlooked because they’re “doing fine,” but they still need to feel valued. It’s about motivating your high performers and keeping them engaged.

Preparing for the Fall and Winter Retail Season

Finally, what advice would you give CPG brands as they head into the fall and winter of 2024?

Brian: First off, make sure you’re in stock and your shelves are full. The holidays—Halloween, Thanksgiving, Christmas—are coming up fast, and competition is fierce, especially with seasonal products. If you’re not in those promotional programs, focus on expanding your shelf space and closing any inventory gaps. Look at your high performers and replicate what’s working in other stores. You might also consider doing demos in low-performing stores to boost visibility. Every brand has strengths during different seasons, so it’s all about timing and adapting your approach.