Retail execution has never mattered more.

Shelves change daily, shopper expectations are higher, and brands can’t afford missed displays, empty facings, or slow reactions.

This guide will help you move from basic store checks to smart, data-driven actions that actually drive sales. You’ll learn what great execution looks like in 2026, why field teams need simpler workflows, and how technology, automation, and analytics can turn insights into real results.

Let’s break it down into practical steps you can use right away.

What Is Retail Execution in 2026?

You might start by asking, what is retail execution today. In simple terms, it’s the day-to-day work that makes products win on the shelf. It’s about making sure shoppers can see, find, and buy your items without friction.

The focus stays on in-store excellence: product availability, clear visibility, correct pricing, and effective promotions.

What’s changed for 2026 is data.

Digital shelf insights now show you real-time gaps, out-of-stocks, display issues, and pricing errors. Instead of guessing, teams can act quickly and confidently. This shift makes the work smarter, not just harder.

It’s no longer just a field activity. Marketing, sales, supply chain, and category teams all contribute. They share data, set priorities, and align actions so stores don’t get mixed messages.

It’s helpful to see how it differs from nearby functions:

- Trade marketing builds plans and budgets.

- Merchandising focuses on displays and planograms.

- Sales activation drives conversion and demand in specific moments.

They overlap in store visits, promotions, and shelf improvements. Teams often confuse the terms because they all touch the shelf, but the purpose is different. One drives planning, one drives presentation, one drives action.

Think of this work as the bridge between brand strategy and field execution. Big goals turn into specific tasks: fix a price, build a display, restock a product.

Ownership is shared. Brand teams set priorities, field reps execute tasks, brokers manage accounts, and merchandisers handle physical fixes.

In CPG, that mix is common: internal reps, outsourced crews, and partners. Clear alignment prevents duplicated work and missed priorities, so everyone moves in the same direction.

The State of Retail Execution in 2026

2026 is definitely a turning point. In-store performance matters more than ever, and brands feel the pressure.

When shelves are empty, prices are wrong, or displays are missing, sales drop fast. The cost of poor execution keeps rising because shoppers switch brands instantly.

One bad shelf moment can lose a customer, not just a sale.

Retailers now expect flawless compliance. They want planograms followed, promos set up on time, and pricing matched exactly. In practical terms, that means teams should:

- Set up displays and promotions on the exact agreed date

- Follow the planogram layout without substitutions

- Match pricing to retailer requirements and promo rules

- Keep shelves full and correct facings in place

- Provide proof with photos or quick check-ins

If you don’t meet standards, you risk penalties, lost space, or tighter rules. The message is clear: do what was agreed, and do it consistently.

At the same time, the digital shelf and omnichannel shopping are the new normal. Shoppers check online reviews, inventory, and pricing before stepping into stores. That means physical shelves and digital shelves must match.

If a product looks available online but isn’t in-store, trust breaks. Brands need visibility across both worlds to stay competitive.

AI and automation are changing how teams work. Tasks that once took hours (like spotting out-of-stocks or checking promotions) now take minutes. Smart tools flag issues, suggest fixes, and help reps prioritize the right stores.

Instead of guesswork, teams focus on high-impact actions. This is where retail execution monitoring becomes a core habit, not a nice-to-have.

And after years of disruption, store visits are back. With supply chains stabilizing, reps can spend more time building displays, checking shelves, and strengthening retailer relationships. In-person visits combined with real-time data create a powerful advantage.

Brands that blend both win faster, waste less time, and execute with confidence.

Core Retail Execution Challenges Brands & Distributors Face Today

Retail teams face a handful of recurring challenges that slow execution and hurt results. The biggest issues are practical, not theoretical, and they show up every day in the field:

- Inconsistent store checks create blind spots and unreliable data.

- Missing photos and key metrics break reporting and hide real issues.

- Out-of-stocks, phantom inventory, and planogram misses drain sales.

- Outdated data delays action and leads to wrong assumptions.

- Retailer systems often don’t match shelf reality, so demand goes unmet.

- Multiple disconnected tools make work slow and handoffs messy.

- Complex visit forms cause “check-the-box” behavior and skipped steps.

- Low field adoption hurts accuracy, motivation, and follow-through.

- Vanity metrics leave leaders without actionable insights.

- Weak data links make it hard to connect execution to sales outcomes.

The fix isn’t complicated: simplify workflows, standardize what “good” looks like, and give teams clearer, cleaner data. When retail execution challenges become visible and manageable, every visit starts to move the business forward.

💡 Pro Tip

Track repeat issues by store. Persistent gaps usually signal systemic causes, not rep performance problems.

Retail Execution Strategies That Actually Work

The brands winning in 2026 aren’t relying on luck. They’re using simple, repeatable, practical approaches that turn store visits into real results.

Below are seven strategies you can put to work right away. No overthinking, no complicated playbooks, just clear steps that drive better execution.

Strategy #1 – Define Clear Retail Execution Standards by Channel and Retailer

Standards create consistency. Without them, every rep interprets “good execution” differently, and results swing wildly from store to store.

The smartest move is to build separate standards for grocery, club, mass, convenience, specialty, and independent stores. Each channel has different shelf rules, shopper patterns, and space constraints, so one universal rule set won’t work.

Break your standards into simple buckets:

- Availability

- Facings

- Planogram compliance

- Pricing

- Promotions

- Secondary placements

These categories make expectations easy to remember and act on. Then give reps retailer-specific reference guides, including planograms, display examples, and price expectations.

Don’t rely on text alone. Use visual examples so merchandisers know exactly what “good” looks like. A picture reduces confusion and speeds up training.

Clear standards also improve data quality. When teams evaluate the shelf the same way, you reduce variability across markets. That means cleaner reporting, more accurate insights, and better decision-making.

And because everyone is aligned, execution speeds up: teams act faster, fix issues quicker, and drive better consumer goods retail execution across channels.

Strategy #2 – Build Visit Playbooks for Merchandisers and Field Reps

A store visit shouldn’t feel like guesswork. Create repeatable workflows that outline what to do first, second, and last.

Playbooks remove uncertainty and help reps move with confidence and speed. A simple flow might look like:

- Take shelf photos

- Check out-of-stock items

- Verify pricing and promos

- Restock or request replenishment

- Build displays or correct facings

- Speak with department managers

- Collect feedback

This creates a clear rhythm and eliminates wasted steps. It also supports new hires, who can become productive faster because they don’t have to figure everything out on their own.

Not all stores are equal, though. Build different playbooks for core, high-value stores versus long-tail locations. Core stores may require deeper audits and extended tasks. Lower-priority stores may only need a quick maintenance check.

This ensures reps spend time where it matters most.

Playbooks reduce cognitive load. Instead of thinking, “What should I do next?” reps focus on action. Visits become faster, more consistent, and easier to coach. Managers can see where reps get stuck and offer targeted support.

Over time, this consistency compounds into higher execution quality and better sales outcomes.

Strategy #3 – Turn Retail Execution Monitoring Into a Feedback Loop, Not a Report

Too many reports sit unread. Data isn’t valuable unless it drives action.

Change the mindset from “reporting” to “improving.” Think of monitoring as a weekly feedback loop, not a scoreboard.

Field managers should review trends regularly and coach reps using real photos and metrics. Instead of saying, “Your compliance is low,” they can point to specific gaps and offer clear next steps.

This builds confidence and accelerates improvement.

Share insights back with sales, supply chain, and marketing teams. If a promo fails because displays weren’t executed, marketing should know.

If out-of-stocks spike in a region, supply chain needs visibility. Collaboration prevents isolated fixes and drives systemic improvements.

Use simple root-cause methods to identify patterns. For example, recurring out-of-stocks in a cluster of stores might indicate delivery delays—not field execution issues. A few quick tools help teams dig deeper:

- 5 Whys → keep asking “why?” until you reach the true cause

- Pattern scanning → look for trends across stores, reps, days, or regions

- Process check → verify ordering, delivery, and replenishment workflows

- Data triangulation → compare field photos, POS data, and retailer systems

- Partner validation → confirm assumptions with distributors or store managers

These lightweight techniques prevent overreacting to symptoms and help teams fix the real problem faster.

A good feedback loop keeps progress continuous, not once a quarter, but every week. The outcome is a culture of learning, not blaming.

Strategy #4 – Align Retail Execution With Promotions, Trade Spend, and Shopper Marketing

Promotions cost money.

If the display never goes up or the price isn’t correct, trade dollars are wasted. Synchronize retail execution tasks with promo timelines: set-up dates, display requirements, and price points. Make sure reps know what’s expected before they arrive in-store.

Track display compliance in real time. If compliance drops, you can fix issues while the promo is still live, not after it ends. Better coordination between brand, sales, and shopper teams ensures stores get the right materials on time.

Tie promo outcomes to execution quality. That’s where the real learning happens. To make this practical, focus on four simple steps:

- Check display execution quality first → is the promotion actually set up as intended?

- Compare performance across execution levels → strong execution vs. weak execution.

- Diagnose the driver of results → great results + great execution = effective promo; weak results + poor execution = execution issue, not promo issue.

- Feed insights into the next cycle → adjust either the promo strategy or the in-store execution plan.

Strategy #5 – Use Data to Prioritize High-Impact Stores and Categories

Not every store deserves the same time investment. Rank stores by revenue contribution, velocity, historic compliance, and upside potential. Predictive indicators (like out-of-stock likelihood or promo windows) help decide where reps should go next.

Move from “visit every store the same way” to “visit the stores that will move the needle.” This shift increases ROI and stretches limited field resources further. Use data to focus on categories that drive growth, not just SKUs that are easy to check.

💡 Pro Tip

Recalculate store priority monthly. Retail dynamics change faster than legacy routing plans.

When teams act on impact, not habit, results accelerate.

Strategy #6 – Simplify Store Check Forms and Automate What Can Be Automated

Complex forms kill productivity. Many field teams deal with bloated checklists full of low-value questions. Strip forms down to essentials: availability, facings, pricing, promos, and photos.

Automate where possible:

- Use image recognition to extract shelf data

- Auto-fill product lists

- Pre-populate store details

Simpler workflows mean higher adoption, faster visits, and better data quality. Reps stay focused on fixing shelves, not filling forms. Automation removes admin work and frees field teams to solve real problems.

Strategy #7 – Integrate Retail Execution With Brokers, Distributors, and Third-Party Merchandisers

Execution often involves multiple partners. If they’re not aligned, tasks overlap and issues slip through the cracks. Use shared dashboards so everyone sees the same performance metrics. Standardize KPIs and visit expectations across partners.

Build automated escalations. For example, if a rep submits an out-of-stock issue, trigger a notification to distributors immediately.

This keeps shelves full and eliminates delays.

Integration turns fragmented teams into a unified field force. You get wider coverage, fewer gaps, and faster execution. It’s one of the most powerful retail execution strategies you can implement because it connects every player in the process.

Pillars of Modern Retail Execution Management

Modern retail execution starts with a clear plan. You don’t win at the shelf by reacting. You win by preparing.

| Stage | What it means | What to do |

| Planning | Prioritize time and territories | Map territories, segment stores by potential, set visit cadence (more for high-growth/problem stores, fewer for steady ones), adjust as performance shifts |

| In-store execution | Ensure promotions and basics are right | Use simple checklists (availability, pricing, visibility, promos), capture photos, validate on the spot, assign corrective tasks immediately |

| Real-time monitoring | Fix issues before they hurt sales | Track coverage and execution during the day, use alerts for out-of-stocks or missed displays, act fast rather than post-mortem |

| Analytics & reporting | Align teams on impact | Provide dashboards by function: sales (revenue), marketing (promo lift), finance (trade ROI); use leading + lagging indicators |

| Continuous improvement | Make execution sharper over time | Test small changes at shelf level, measure results, share wins across markets, refine processes regularly |

As you can see, modern retail execution works like a cycle: plan, execute, monitor, analyze, improve. Repeat it, and you’ll build a system that gets sharper every month.

Retail Execution Tools and Platforms in 2026

The tech landscape for retail execution has shifted fast. In 2026, brands and distributors are choosing platforms that simplify work, connect data, and help teams act faster in stores, not just collect information.

Types of Retail Execution Tools: Point Solutions vs. Unified Platforms

Retail teams typically face two types of retail execution tools: point solutions and unified platforms.

| Tool type | What it is | Pros | Cons |

| Point solutions | Handle a single task, like photo capture or surveys | Easy to start, focused features | Multiple logins, scattered data, hard handoffs, higher costs over time |

| Unified platforms | Combine store checks, routing, orders, tasks, and reporting in one system | One workflow, shared data, better collaboration, clearer insights | Requires initial setup and alignment |

Many brands are consolidating tools because fragmented systems slow teams down. A unified approach supports smoother retail execution, stronger visibility, and faster issue resolution across partners.

💡 Pro Tip

Track login frequency. Low usage usually reveals workflow friction, not motivation problems.

Integrating Retail Execution Tools With CRM, ERP, and Trade Promotion Systems

Retail execution doesn’t live in a vacuum. The best platforms integrate with CRM, ERP, and trade promotion systems. That means data flows cleanly between customer records, inventory, pricing, and promotional plans. When systems talk to each other, teams avoid manual entry and errors.

Integration unlocks real ROI because:

- Field data updates inventory and ordering instantly

- Promo execution ties back to spend and lift

- Sales teams see real shelf conditions

- Leadership gets one version of the truth

This shift turns execution into action, not just reporting.

Must-Have Features for Field Teams and Merchandisers

In 2026, practical features matter more than flashy dashboards. The essentials include:

- Offline access for low-connectivity stores

- Mobile photo-capture workflows for fast shelf proof

- Planogram reference built into the app

- Smart routing so reps visit the right stores

- Real-time compliance scoring to spot gaps immediately

- Visit playbooks to guide consistent store actions

These features cut admin work and help reps spend more time fixing shelves, building displays, and strengthening retailer relationships.

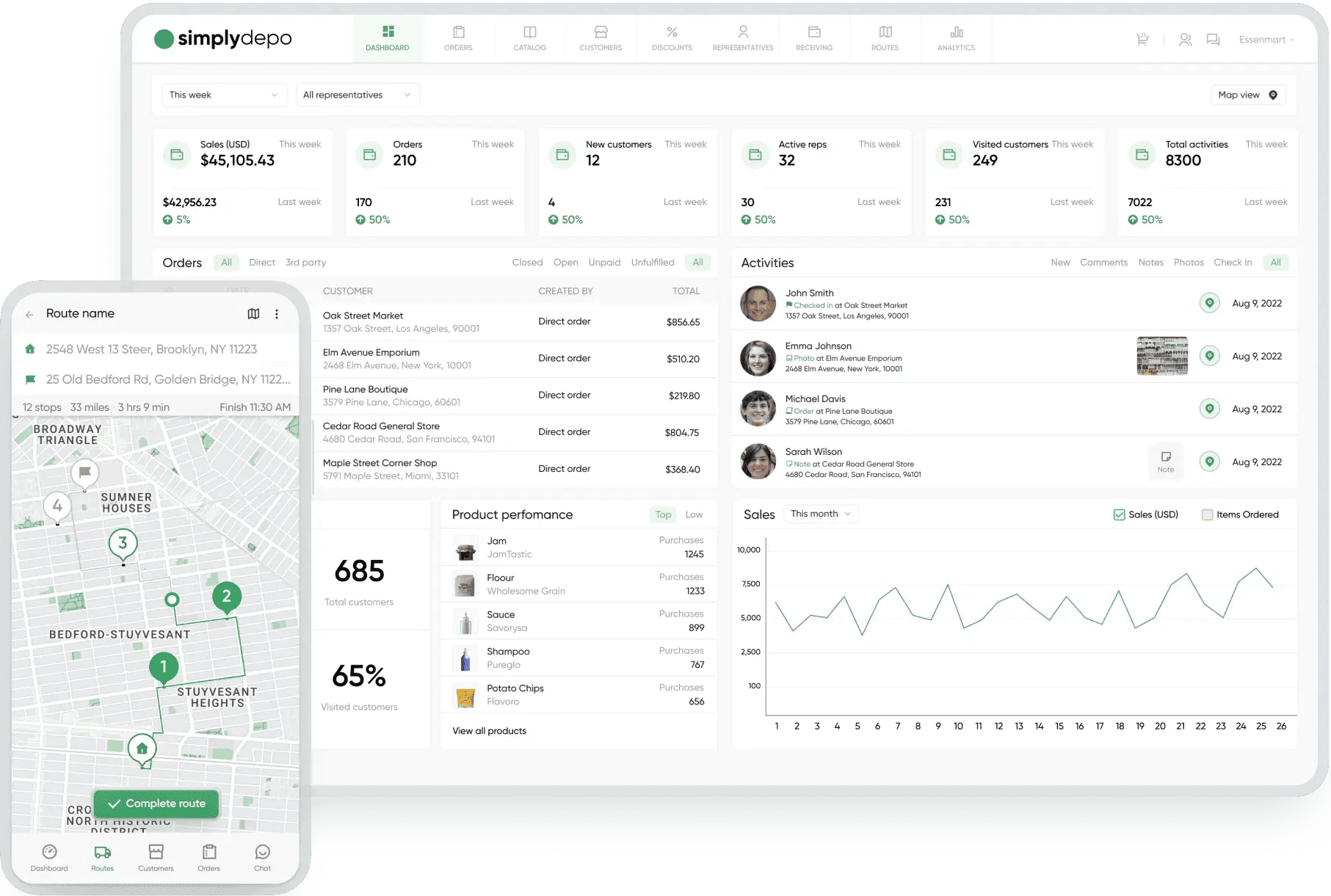

SimplyDepo: A Real Example of a Unified Platform

Most retail execution tools still live in silos:

- One for photos

- One for routing

- One for orders

- One for reporting.

SimplyDepo takes a different approach. It gives brands, distributors, and merchandisers one connected platform where store visits, orders, workflows, and insights all work together.

That means less admin work, fewer handoffs, and faster shelf improvements.

At its core, SimplyDepo helps teams execute, not just observe. Reps can capture data, place orders, log issues, and complete tasks directly in the field, while managers track progress in real time.

What Makes SimplyDepo Practical for Field Teams

The platform is built for the realities of CPG: busy stores, fast visits, unpredictable connectivity, and limited time. Field teams benefit from:

- Mobile offline functionality for low-signal stores

- Simple checklists and forms to speed up visits

- Photo capture with visual validation for instant proof

- Optimized routing so reps prioritize high-value locations

- Integrated order entry during store visits

- Task assignments that trigger fixes immediately

Instead of collecting information and hoping someone acts on it later, SimplyDepo turns store observations into tasks, orders, or escalations, the right away.

A Clear View of Performance Across Accounts

HQ and field leaders don’t need multiple spreadsheets or disconnected reports. SimplyDepo consolidates execution, ordering, and coverage into one shared picture.

Teams use dashboards to spot patterns, risks, and opportunities faster.

| What you see | Why it matters |

| Compliance and display execution | Fix missed promos before lift is lost |

| Order volume and trends | Allocate reps and trade dollars wisely |

| Store-level insights and photos | Understand what’s really happening on the shelf |

| Field productivity and coverage | Coach teams and improve routing |

| Buyer and account history | Strengthen retailer relationships |

This alignment translates into measurable outcomes: customers report a 24% increase in sales, 93% buyer retention, and 14 hours saved per rep every week.

Built to Fit Into Existing Workflows

SimplyDepo doesn’t require ripping out systems.

It integrates with QuickBooks, Shopify, HubSpot, Stripe, Salesforce, Zapier, and other tools, so retail execution data flows into inventory, finance, CRM, and trade promotion systems.

Pricing scales with team size, onboarding is fast, and support is hands-on – a reason it holds 4.8 stars on G2 and 5 on Capterra.

SimplyDepo reflects where retail execution is heading in 2026: simpler workflows, smarter decisions, streamlined collaboration, and faster action at the shelf.

For brands and distributors looking to unify sales, merchandising, and execution without complexity, it delivers a practical, proven path forward.

Smart Retail Execution: From Store Checks to Smart Actions

“Smart” retail execution isn’t just digital. It’s faster, more focused, and driven by insight instead of manual guesswork. The big shift is simple: less time collecting data, more time fixing what matters.

Smart systems use automation, predictive insights, and real-time recommendations. They cut admin work like typing notes or sorting photos. Instead, reps spend time on value-added corrections: restocking, fixing prices, improving displays, and talking with store managers.

Prioritization becomes a core habit. With retail execution analytics, teams stop working purely by geography and start working by opportunity. In practice, that means:

- Rank stores by upside, not location

- Identify where promotions will deliver the biggest lift

- Predict stockouts or execution gaps before they happen

- Deploy reps and budgets where the return will be highest

AI also helps plan smarter visits. Personalized daily plans tell reps which stores to visit and why. Suggestions draw from past performance, so effort focuses on problem patterns, not guesswork.

Image recognition takes speed to another level. It can auto-detect out-of-stocks, pricing errors, and missing displays. Audits that used to take 30 minutes can take five. Accuracy improves because the camera doesn’t miss details or rush through steps.

The most powerful part is closing the loop. Smart systems don’t just flag issues. They trigger actions. They can:

- Assign tasks automatically to reps or merchandisers

- Push replenishment alerts to ordering systems

- Notify trade teams when promos aren’t executed

Everything becomes connected, so nothing falls through the cracks. Smart retail execution turns data into decisions, decisions into tasks, and tasks into results.

It creates a system where every visit has purpose, every action has impact, and every team moves faster with confidence.

Retail Execution for Consumer Goods & CPG Brands

Retail execution looks different depending on where a brand is in its journey. Emerging and established players share the same shelf, but their priorities aren’t the same.

| Category | Emerging CPG brands | Established CPG brands |

| Primary goal | Build awareness, velocity, and presence | Scale execution and maintain consistency |

| Retail reality | Limited distribution – every store matters | Broad distribution across thousands of stores |

| Key focus areas | Availability, facings, promotions, staff awareness | Planogram and promo compliance, category leadership |

| Execution tactics | Sampling, demos, rapid feedback loops | Standardized processes, strong reporting |

| What analytics track | Velocity, trial, store-by-store performance | Compliance rates, coverage, category impact |

| Field strategy | Frequent visits to validate basics and adapt fast | Coordinated teams delivering repeatable execution |

| Success looks like | Proving demand and earning more doors | Sustained share, retailer trust, efficient scale |

As brands grow, priorities evolve, but one challenge remains universal: adapting execution to different markets, cultures, and retail environments. That’s where the next layer comes in.

Global vs. Local: Adapting to Market Nuances

As brands grow across regions, execution gets more complex. Not every market looks or behaves the same.

Differences to consider:

- Store formats vary: hypermarkets, convenience stores, hard discounters, and specialty shops all require different tactics.

- Regional retailer requirements can change the rules on pricing, displays, and audits.

- Localized playbooks ensure reps know what “good” looks like in each market, not just in HQ.

You’ll need flexibility. What works in one country may flop in another. Local insights help tailor promotions, packaging placement, and visit frequency. Global standards create structure, but local adjustments drive results.

Still, matter-of-factly, across all sizes and markets, brands are moving toward smart retail execution. The goal is simple: use data to guide decisions, prioritize the right stores, and act faster. Whether you’re scrappy and growing or scaled and complex, smarter workflows help teams spend less time checking and more time improving the shelf.

In the end, the brands that adapt (not just expand) win.

Building a Data-Driven Retail Execution Analytics Framework

A strong analytics framework starts with clear, consistent KPIs. When everyone measures the same things the same way, you can compare stores, reps, and regions without confusion. Standardizing KPIs also helps teams focus on what truly drives growth.

Core retail execution KPIs usually include:

- Distribution (Is the product on the shelf?)

- Facings (How much space does it get?)

- Share of shelf (How it compares to competitors)

- Price

- Promo compliance

Each one ties directly to sales. If a product isn’t present, you lose the sale. Fewer facings reduce visibility. Poor price execution hurts conversion. Missing promos means missed lift. That’s why benchmarks and targets matter. They set a clear definition of success.

Next, connect execution to outcomes. Linking retail data to sales lift and ROI helps you see what’s working. Remember, correlation isn’t causality. A sales spike doesn’t always mean a display caused it, so measure impact properly: compare test vs. control stores or pre- vs. post-execution results.

Dashboards should fit the audience. Field reps need simple, actionable views: what’s wrong, where, and what to fix today. HQ leadership needs rollups that show trends, performance gaps, and investment impact across markets. Both levels support smarter retail execution management.

Cadence matters, too. Weekly reviews help teams correct issues fast: out-of-stocks, pricing errors, or missing displays. Monthly or quarterly insight cycles are better for spotting bigger patterns and planning strategy shifts.

Data quality can make or break the framework. Common issues include:

- Missing photos

- Incorrect product tags

- Retailers using different data formats

The fixes are straightforward: tighter checklists, automated tagging, and standard templates. The cleaner the data, the better the decisions.

A data-driven approach doesn’t complicate execution. It simplifies it. When you trust the numbers, you can act faster, invest smarter, and turn shelf insights into real growth.

Integrating a Retail Execution Software into Your Processes: Step-by-Step

Rolling out new software can feel overwhelming, but a clear plan makes it smooth and successful. Think of it as a series of simple steps that take you from scattered processes to a streamlined, data-driven workflow.

Step 1: Define Objectives: What Problems Are You Solving in Retail Execution?

Start with clarity. Before touching software and considering its pricing, decide what you want to fix in retail execution. Are you trying to reduce out-of-stocks? Improve promo compliance? Standardize store checks?

Pick a few KPIs and issues to fix first. Don’t try to solve everything at once. A focused approach delivers faster wins and builds confidence across your team.

Step 2: Map Current Field, Merchandising, and Store Check Processes

Next, document how work happens today. How do reps check shelves? How do merchandisers report issues? Where does data go?

Look for:

- Duplicate steps

- Manual paperwork

- Slow handoffs

- Missing proof

These redundancies and pain points show you what the software must improve.

Step 3: Select the Right Retail Execution Platform for Merchandisers and Field Teams

Now that you know your gaps, evaluate tools with purpose. Consider:

- Ease of use (especially on mobile)

- Photo capture and validation

- Task assignment and tracking

- Real-time dashboards

- Integrations with CRM, ERP, or ordering systems

Prioritize features that cut admin time and help reps act faster in stores. If teams won’t use it daily, it won’t deliver results.

Step 4: Pilot With a Subset of Stores, Reps, and Retailers

Don’t launch everywhere at once. Test with a small but representative group. Include different store types, regions, and experience levels. Best practices:

- Run the pilot for 6–12 weeks

- Measure before-and-after results

- Gather feedback weekly

- Adjust workflows quickly

The goal is proof, not perfection. This stage gives you a clear picture of how the retail execution software supports retail execution management and whether it drives real impact.

Step 5: Training, Change Management, and Driving Adoption in the Field

Technology only works if your people use it. Keep training simple and hands-on. Show reps how the software saves time, not adds steps.

Focus on:

- Simple workflows

- Short training videos

- Coaching and feedback loops

- Clean, intuitive mobile UX

Celebrate quick wins. Share success stories. Ask for input. When teams feel heard and supported, adoption sticks.

Common Retail Execution Mistakes and How to Avoid Them

Retail execution breaks down when teams fall into avoidable habits. To keep things practical and high-impact, watch out for these common pitfalls:

- Treating execution as an audit only → collecting data without triggering action at the shelf

- Overloading store check forms → long, complex forms slow reps and create bad data

- Ignoring field feedback → reps see real problems retailers and HQ may miss

- Buying tools without a strategy → software won’t fix unclear processes or ownership

- Separating execution from outcomes → track shelf actions alongside sales and trade results

Avoiding these traps creates faster fixes, better data, and execution that actually drives revenue, not just reporting.

The Future of Retail Execution Beyond 2026

The future of retail execution won’t be slow, reactive, or generic. It will be personalized, proactive, and built for real-world agility. Expect shifts like:

- Dynamic shelves, with hyper-local assortments and planograms that evolve by neighborhood, season, and demand

- Predictive decision-making, using real-time retailer data to spot risks, like stockouts, before they happen

- AI coaching in the field, guiding reps on what to check, fix, or prioritize for maximum lift

- Cross-functional execution, where sales, category, and supply chain teams operate as one system

- Evolving field roles, moving from auditing to problem-solving, influencing, and rapid action

- Automated analytics, turning massive data sets into clear priorities and next steps

The future won’t just improve execution. It will shorten the path from insight to action, making every store visit more impactful.

Conclusion

A strong retail execution approach in 2026 isn’t about checking boxes. It’s about turning shelf insights into fast, confident action.

When teams align standards, simplify workflows, and use connected tools, every visit can drive real growth. The brands that win will be the ones that stay data-driven, adaptive, and collaborative across field, sales, and supply chain.

And if you’re exploring how modern platforms can support that journey, you can always look at options like SimplyDepo and even book a demo to understand what a streamlined, end-to-end workflow could look like for your team.

Retail Execution FAQs

How often should field reps update store data?

Ideally every visit, but at least weekly for priority stores. Fresh data drives faster decisions and prevents small problems from becoming big ones.

Do small brands need retail execution software?

Not always. If you have fewer stores and reps, simple tools may work. Once visits increase and data becomes messy, software adds clarity and saves time.

How can teams reduce out-of-stocks quickly?

Create a fast escalation path: store report → distributor → replenishment. Speed matters more than perfect reporting.

Can retailers influence execution results?

Yes. Strong relationships with store managers often unlock better display space, faster fixes, and easier negotiations.

How do I measure if visits are effective?

Check what changed after the visit (stock levels, pricing corrections, displays built), not just time spent.

How can HQ stay aligned with the field?

Share short weekly summaries: wins, issues, and top priorities. Alignment improves faster than adding more dashboards.

Boost Sales.

Cut Manual Work.

Streamline ordering, routing, and retail execution — while giving every rep the tools to grow accounts faster.

-

+15h

Save weekly

per rep -

93%

Increase

buyer retention -

24%

Increase

in retail sales

Error: Contact form not found.