Stockouts and overstock still hurt profits, even with better data and faster tools.

And yet, confidence across retail remains high. Despite expectations of slower economic growth and continued pressure on consumer spending in some regions, 96% of global retail executives expect industry revenues to grow in 2026, and 81% anticipate margin expansion.

In this environment, the difference isn’t effort. It’s how early you see problems and how fast you act. That’s where inventory forecasting becomes a real advantage, not just a planning task.

This guide breaks it down simply. You’ll learn what’s changed, what still works, and what matters now. We’ll cover methods, tools, metrics, and real-world use cases across retail, ecommerce, and CPG. You’ll also see how teams turn signals into action.

By the end, you’ll clearly understand how to do inventory forecasting in a way that prevents issues before they show up.

What Is Inventory Forecasting?

At its core, what is inventory forecasting? It’s the practice of predicting how much stock you’ll need, where, and when. You look ahead using sales history, trends, and real-world signals.

The goal is simple: have the right items available without tying up cash.

Why it matters so much? Inventory forecasting directly impacts three things you care about:

- Profit. Fewer markdowns and rush orders.

- Cash flow. Less money stuck on shelves.

- Service levels. Store availability ensures products are there when customers want them.

It also keeps teams aligned. Buying, ops, and sales work from the same plan.

Plus, it helps to separate a few ideas:

- Demand forecasting estimates what customers will buy.

- Inventory forecasting turns that demand into stock decisions.

- Replenishment executes the plan by placing orders and timing restocks.

Together, they help you stay balanced. Not too much. Not too little. Just right.

Core Inventory Forecasting Methods Every Retail & CPG Team Should Know

Good inventory forecasting starts with proven basics. You don’t need magic. You need methods that work and data you already have.

Let’s begin with the classics.

These models are simple, reliable, and still powerful in 2026:

- Moving averages smooth out daily noise. They’re great for stable items.

- Seasonal indexes adjust for predictable peaks like holidays or summer demand.

- Trend models capture long-term growth or decline.

Next, layer in real-world signals. Sales history alone isn’t enough. You’ll get better results when you also factor in:

- Promotions that spike short-term demand.

- Seasonality that repeats every year.

- Recent changes in pricing or channels.

This is where modern inventory forecasting methods shine. They connect patterns instead of guessing.

💡 Pro Tip

Separate baseline demand from promo demand early. Mixing them hides true performance and creates planning noise.

Finally, set the right parameters.

Forecasts only work when constraints are clear and agreed on. First, safety stock protects you from surprises when demand or supply shifts unexpectedly. Next, lead times define how early you must act, so decisions happen before it’s too late.

Finally, service levels set how often you want items available, helping you balance customer expectations with inventory risk.

Together, these constraints turn forecasts into practical, reliable plans.

Get these right, and inventory forecasting becomes predictable, not stressful.

When to Move Beyond Manual Spreadsheets to Inventory Forecasting Tools

Spreadsheets are a great starting point. They’re familiar. They’re flexible. And for a small catalog, they work fine. Until they don’t.

You’ll feel the cracks when things scale. More SKUs. More locations. More promotions. Suddenly, updates take hours. Errors sneak in. Versions don’t match. Decisions lag behind reality.

That’s your first signal.

Another sign is speed. If you’re spending more time maintaining files than making decisions, the tool is holding you back. The same goes if you can’t easily test scenarios or see what changes next week.

Then there’s complexity.

Manual sheets struggle when you’re:

- Managing long or variable lead times

- Balancing service levels across channels

- Adjusting for frequent promos or seasonality

At this point, forecasting inventory by hand becomes risky. Small mistakes turn into stockouts or excess stock fast.

Inventory forecasting tools step in here. They automate updates. They connect data sources. They recalculate instantly when inputs change. Most importantly, they let you focus on actions, not formulas.

You don’t move on because spreadsheets are bad. You move on because your business outgrew them.

💡 Pro Tip

If one person owns the spreadsheet, you already have a single point of failure. That’s a risk, not a process.

Inventory Forecasting Tools in 2026

Inventory forecasting in 2026 looks very different than it did a few years ago. Retail execution software is faster, smarter, and easier to use. You don’t need to be a data expert to get value.

First, know the main tool categories.

Types of Inventory Forecasting Tools: ERP Modules, Cloud Apps, and AI-First Platforms

Most teams choose from three options:

- ERP modules. These live inside your core system. They’re convenient but often basic.

- Cloud apps. These plug into your stack and focus only on planning and forecasting.

- AI-first platforms. These adapt quickly, learn patterns, and scale with complexity.

Each has a place. Your choice depends on speed, flexibility, and how complex your business is.

Next, focus on what the tool must do well.

Must-Have Features in Inventory Forecasting Tools for Retail and CPG

Modern inventory forecasting tools should help you move faster and smarter. Look for features like:

- Forecasting inventory based on sales, promotions, and seasonality together

- Easy scenario planning so you can test “what if” decisions

- Built-in safety stock and lead time logic

- Clear alerts when risks appear

- Simple dashboards your whole team understands

Integration matters too.

If the tool doesn’t connect cleanly to your POS, ERP, or WMS, you’ll lose trust fast. Clean data in means better decisions out.

Finally, think about usability.

If planners don’t enjoy using the tool, they won’t rely on it. The best platforms guide action, not just display numbers.

Retail Inventory Forecasting

Retail execution moves fast. Customers shop across stores, apps, and marketplaces. That’s why inventory forecasting in retail has to react in near real time, not weeks later.

Using Real-Time POS and Online Data to Forecast Inventory by Location and Channel

Start with live data.

Modern teams use real-time POS and online signals to see demand as it happens. This lets you forecast by:

- Store and region

- Online vs in-store channels

- Time of day or day of week

You’ll spot shifts early. You can move stock before shelves go empty or backrooms overflow. This is the foundation of strong retail inventory forecasting.

💡 Pro Tip

Rebalance inventory before you reorder. Moving stock is often faster and cheaper than buying more.

Handling New Products, Short Life Cycles, and Fast Fashion in Retail Inventory Forecasting

Next, handle products that don’t behave nicely.

Retail is full of curveballs. New launches. Short life cycles. Fast fashion trends that explode and vanish. For these, history is thin or useless. Instead, you rely on:

- Early sales velocity

- Similar product patterns

- Rapid reforecasting as data arrives

The goal isn’t perfection. It’s speed and fast correction.

Inventory Forecasting for Promotions, Events, and Peak Seasons (Black Friday, Holidays, Ramadan, etc.)

Then plan for peaks before they hit.

Promotions and events can break weak plans because demand spikes fast and hard. Black Friday, holidays, Ramadan, and flash sales don’t behave like normal weeks, so treating them the same creates risk.

Smart teams isolate promo-driven demand first, then forecast uplift separately instead of blending it into baseline sales. At the same time, they lock in inventory earlier for items with long lead times.

This approach keeps promotions profitable, controlled, and far less chaotic.

Finally, connect it all into one view.

Good inventory forecasting brings together daily sales, product life cycle stage, and event calendars. You don’t guess. You adjust continuously.

Ecommerce Inventory Forecasting

Ecommerce plays by different rules than store-only retail. Demand moves faster. Visibility is higher. Mistakes show up instantly.

The biggest difference is scale and speed.

Online stores serve many regions from fewer fulfillment points. A small forecast error can affect thousands of orders in hours. That’s why ecommerce inventory forecasting needs tighter feedback loops and more frequent updates.

Data is also richer.

You’re not limited to sales receipts. You can learn from:

- Page views and add-to-cart activity

- Conversion rates by channel

- Traffic spikes from ads or influencers

These signals show intent before a sale happens. You can react earlier.

Another key shift is customer expectation.

Online shoppers expect instant availability and fast shipping. There’s little patience for backorders. You must balance inventory across:

- Warehouses

- Marketplaces

- Direct-to-consumer sites

Finally, returns change the math.

Higher return rates affect true demand and available stock. Forecasts must account for timing, not just volume.

Inventory Forecasting for CPG Manufacturers, Distributors & DSD Teams

CPG inventory forecasting lives closer to the shelf than most people think. What happens in the field often matters more than what’s in the ERP.

Start with real execution data.

Orders tell you what sold. Field data tells you why. Teams improve forecasts when they use:

- Store orders and delivery patterns

- On-shelf availability audits

- Shelf photos showing facings, gaps, and compliance

This data reveals lost sales you’ll never see in invoices. Empty shelves mean demand didn’t disappear. It went unmet.

💡 Pro Tip

Treat on-shelf availability gaps as lost demand, not low demand. Adjust forecasts accordingly.

Next, close the timing gap.

DSD and distributor inventory models move fast. Inventory decisions must react just as quickly. Daily or even intra-week updates help you:

- Reallocate stock before outages spread

- Adjust production signals early

- Support key accounts more accurately

This is where inventory management forecasting becomes practical, not theoretical. It connects field reality to supply decisions.

Finally, align teams around the same signals.

When sales, supply chain, and field teams see the same data, forecasts improve naturally.

How AI Is Transforming Inventory Forecasting

AI is changing how teams plan stock. Not by adding complexity, but by removing guesswork.

This shift is accelerating fast. Nearly 68% of retailers expect to deploy agentic AI for key operational and enterprise activities within the next 12 to 24 months. That tells you where planning is headed. Toward systems that don’t just analyze data, but act on it.

Traditional models wait for patterns to stabilize. AI doesn’t. It learns as data flows in. Sales shift. Promotions hit. Weather changes. The forecast updates fast.

Here’s what that means for you.

AI looks beyond averages and finds signals humans miss. It connects more inputs at once, like:

- Daily sales and demand swings

- Promo performance as it unfolds

- Lead time changes and supply risk

This makes inventory forecasting more responsive and less reactive.

AI also helps with scale.

Managing thousands of SKUs across locations is hard by hand. AI handles that quietly in the background. You get clear actions instead of endless spreadsheets.

Another big shift is confidence.

AI models explain what’s driving changes. You see why a forecast moved, not just that it did. That builds trust across teams.

How to Do Inventory Forecasting in 2026

Inventory planning in 2026 is faster, more connected, and more practical. You don’t start with models. You start with decisions.

First, anchor on clean demand signals.

Pull recent sales. Add promos, launches, and known events. Update often. Weekly is a minimum. Daily is better for fast movers.

Next, define your rules.

Good forecasts need clear guardrails. Set:

- Lead times you can trust

- Service level targets by item or channel

- Safety stock for uncertainty

These rules turn demand into actions.

Then, automate the heavy lifting.

Modern tools recalculate constantly. When inputs change, plans adjust. This removes manual work and reduces delays. You review exceptions, not every SKU.

This is the mindset shift.

Forecasting inventory isn’t about being right months out. It’s about correcting early. Short cycles beat perfect predictions.

Finally, close the loop.

Compare forecast vs actual. Learn quickly. Improve inputs. Share results across teams.

When you follow this flow, forecasting inventory becomes part of daily operations, not a monthly fire drill. You act sooner, stress less, and keep stock aligned with real demand as it evolves.

Key Metrics & KPIs for Inventory Forecasting

Forecasts only matter if you measure the right outcomes. Good metrics show what customers feel, what cash does, and where plans break.

Service Level, Fill Rate, and Stockout Rate: Customer-Facing KPIs

Start with customer-facing KPIs.

These tell you if shoppers get what they want:

- Service level shows how often items are available

- Fill rate measures how much demand you actually meet

- Stockout rate reveals how often shelves go empty

When these slip, sales and trust follow.

Inventory Turnover, Days of Inventory on Hand, and GMROI

Next, watch inventory efficiency.

These metrics connect stock to money:

- Inventory turnover shows how fast products move

- Days of inventory on hand reveals how long cash is tied up

- GMROI tells you how much profit inventory generates

Healthy numbers mean balance. Too high or too low signals risk.

Forecast Accuracy, Bias, and Stability by Category and Channel

Then, track forecast quality.

You want to know if plans are usable, not just accurate on paper.

Start by reviewing forecast accuracy by category and channel to see where plans truly perform. Then look for bias to spot consistent over or under planning that quietly creates risk.

Finally, track stability to avoid constant plan changes that confuse teams and slow execution.

When forecasts stay stable and balanced, teams act with confidence instead of hesitation.

Measuring the Business Impact: Lost Sales Avoided, Markdown Reduction, and Working Capital Freed

Finally, measure real business impact.

This is where inventory forecasting proves its value. Look at:

- Lost sales avoided through better availability

- Markdown reduction from cleaner exits

- Working capital freed from excess stock

Tie metrics together. Review them often. When KPIs improve, planning stops being theoretical and starts driving profit, cash flow, and service in a way everyone can see.

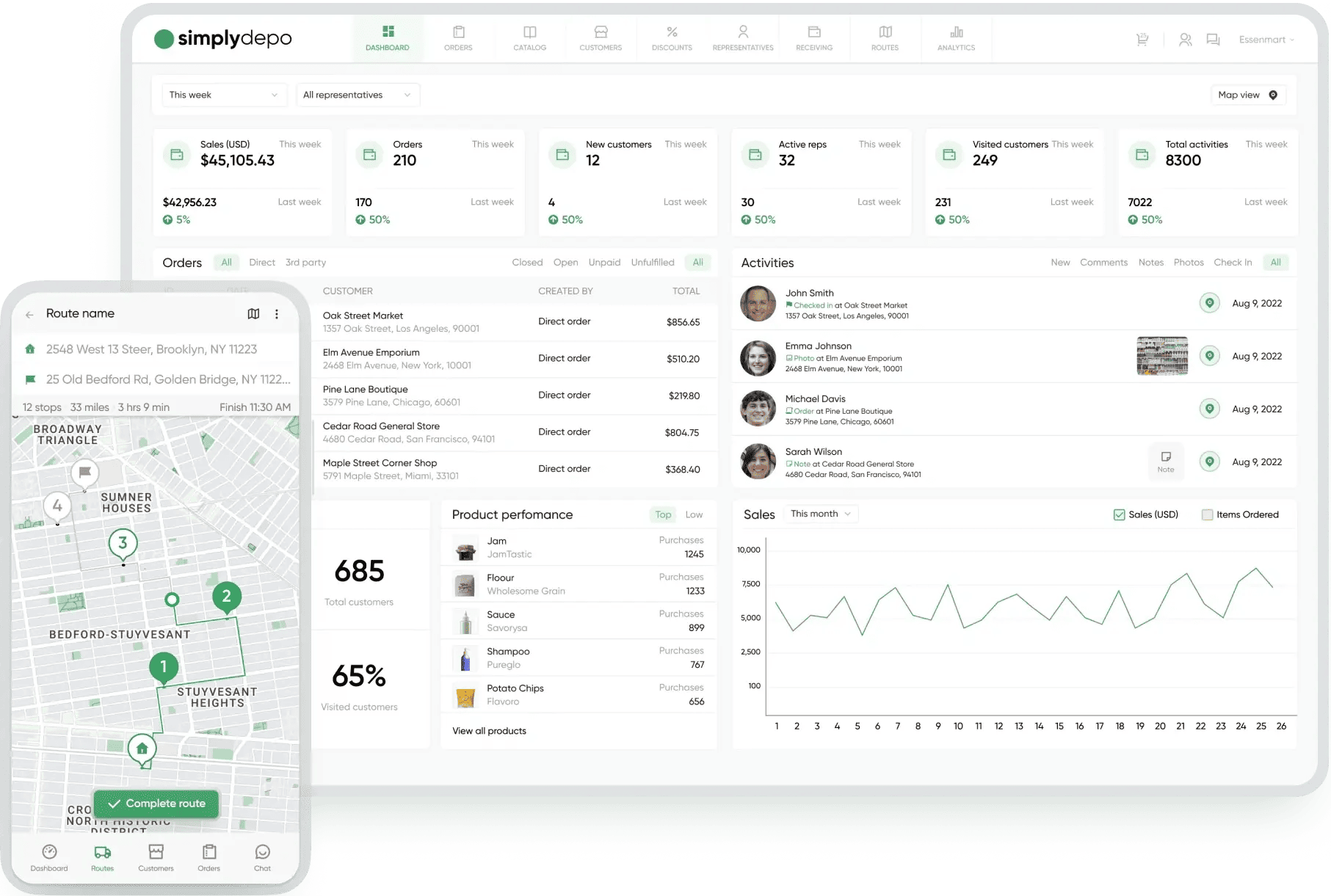

How SimplyDepo Can Support Better Inventory Forecasting in 2026

Better forecasts start with better signals. That’s where SimplyDepo fits naturally into your planning flow.

Real-Time Order and Inventory Visibility

First, get real-time visibility.

SimplyDepo captures orders, inventory levels, and field activity as they happen. You see what customers buy today, not weeks later. This gives planners a clearer picture of true demand across routes, accounts, and regions.

Using SimplyDepo Data as an Input to Your Inventory Forecasting Tools and ERP

Next, feed better data into your planning stack.

SimplyDepo doesn’t replace your ERP or inventory forecasting tools. It strengthens them. Order data, store activity, and execution insights flow directly into your existing systems. Forecasts become grounded in reality, not assumptions.

Closing the Loop: From Forecast → Sales Plan → Field Execution → Actuals in SimplyDepo

Then, close the loop from plan to shelf.

This is where many teams struggle. SimplyDepo connects:

- Forecasts that set targets

- Sales plans that guide reps

- Field execution through orders and visits

- Actuals that feed back into planning

You’ll see gaps early. You’ll fix issues before they turn into stockouts or excess.

It also saves time.

Reps spend fewer hours on admin. Managers see performance instantly. Planning teams get cleaner inputs without chasing spreadsheets.

Most importantly, SimplyDepo helps forecasting stay actionable. It ties planning decisions to what actually happens in the field.

If you want to see how this works in practice, book a demo to check Simply Depo and explore how it supports smarter, faster inventory decisions in 2026.

FAQ – Inventory Forecasting in 2026 for Retail & CPG

What is inventory forecasting and how is it used in retail and CPG?

It’s the process of predicting future stock needs so products are available without overbuying. In retail, it helps place the right items in the right stores and channels. In CPG, it guides production, distribution, and field execution.

Teams use it to reduce stockouts, control inventory costs, and protect service levels.

Which inventory forecasting methods are best for fast-moving consumer goods?

FMCG works best with simple, responsive methods. Moving averages and seasonal patterns are a strong base. Add promo uplift and short planning cycles. Speed matters more than long-term precision. Frequent updates beat complex models that react too late.

How do I start forecasting inventory based on sales if my data is messy?

Start small. Clean recent sales first. Remove obvious outliers like one-time bulk orders. Group SKUs by behavior instead of treating each item as unique. Then improve gradually. You don’t need perfect data to get better results.

What are the best inventory forecasting tools for ecommerce and omnichannel retailers?

Look for tools that update frequently, connect easily to POS and ecommerce platforms, and handle multiple locations. Scenario planning, promo modeling, and clear alerts are more important than fancy charts.

How can distributors and CPG brands use tools like SimplyDepo to improve inventory forecasting accuracy?

SimplyDepo captures real-time orders and field activity. This data feeds planning systems with what’s actually happening in stores. Better inputs lead to better forecasts. It also closes the loop between plans, sales execution, and results, so teams adjust faster and avoid surprises.

Boost Sales.

Cut Manual Work.

Streamline ordering, routing, and retail execution — while giving every rep the tools to grow accounts faster.

-

+15h

Save weekly

per rep -

93%

Increase

buyer retention -

24%

Increase

in retail sales

Error: Contact form not found.