You run a growing B2B brand, and the Order Management Process feels like spinning plates across showrooms, marketplaces, reps, and spreadsheets. Choosing the right wholesale ordering platform can save hours and cut mistakes, but which NuOrder competitors like JOOR, Handshake, RepSpark, Brandboom, Pepperi, or Faire fit your needs?

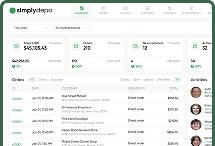

This article compares showroom software and digital wholesale marketplace tools, EDI options, inventory sync, reseller portals, order automation, and ERP integration to help you see what growing B2B teams really need. To help with that, SimplyDepo offers distribution and retail execution software that streamlines the Order Management Process, syncs inventory across channels, supports reseller portals, and makes digital wholesale ordering easier for field teams and buyers.

Summary

- Teams seeking alternatives to their current wholesale ordering platform are primarily motivated by integration gaps, with 75% citing better integration capabilities as their top need.

- Usability drives adoption; 60% of teams prioritize user-friendly interfaces, which translates to fewer support tickets, faster onboarding, and higher first-pass order capture.

- Fragmented data and workflows impose real commercial costs, with companies losing an average of 20% of annual revenue and operational costs rising by up to 30%.

- Standardized digital order capture and catalog control materially improve throughput, with order processing time dropping about 30% and 80% of sales teams reporting increased efficiency after adopting these tools.

- Manual reconciliation creates a heavy back-office burden, with teams reporting 12 to 18 hours per week spent per person on reconciliation tasks, which fuels low morale and defensive data practices.

- Integration and buyer expectations are non-negotiable. 70% of growing B2B teams prioritize seamless system integration, while over 70% of buyers expect personalized experiences, and 50% prefer to purchase online.

- This is where SimplyDepo’s distribution & retail execution software fits in, by providing a single data model that binds order capture, route accounting, mobile execution, and reporting so reconciliations happen automatically and field activity ties directly to orders and cash.

What Teams Mean When They Search “NuOrder Competitors”

Teams searching for “NuOrder competitors” are hunting for more than a prettier catalog. They want a way to stop fractured order and sales workflows from throttling growth by tying field activity, order capture, and reporting into a single, reliable flow.

What are they actually trying to fix?

Pattern recognition, not feature shopping. Buyers are reacting to processes that fragment as they scale: order entry lives in one app, routing in another, reconciliation in spreadsheets. The result is duplicated work, delayed invoices, and managers who cannot tell which visits produced revenue. The NuORDER by Lightspeed 2025 State of B2B Commerce report, published October 1, 2023, underscores this point with 75% of teams searching for ‘NuOrder competitors‘ looking for better integration capabilities. That figure explains why connectors and APIs matter more than fancy product tiles.

How do teams choose between vendors?

Problem-first: usability wins when teams need adoption fast. Procurement can tolerate some integration work if reps actually use the app in the field, which is why the NuORDER report, published October 1, 2023, flags 60% of teams prioritize user-friendly interfaces when searching for ‘NuOrder competitors’. In practice, that means fewer support tickets, faster onboarding, and a higher percentage of orders captured correctly on the first pass.

Why integration alone is not the whole answer

Specific experience, short version: I have seen three systems stitched together with custom scripts, and the team still spends mornings reconciling orders. The hidden cost is not an occasional error; it is a steady drag: missed upsells, slow cash collection, and a sales force spending hours on admin instead of selling. When manual coordination consumes field reps and back-office staff, the business loses momentum in measurable ways.

Most teams manage this by keeping familiar tools and adding point solutions, because it feels low risk. As volume grows and accounts multiply, that familiar approach multiplies exceptions and ad hoc processes, which is why solutions like SimplyDepo gain traction. Teams find that distribution and retail execution platforms that combine mobile sales rep tools, B2B CRM, route accounting, and an order portal cut reconciliation time, provide real-time order visibility, and remove the repeated manual handoffs that cause errors.

A simple comparison to make it concrete

Imagine chasing a single customer order through five inboxes and two spreadsheets, like following a paper trail across a city. It takes time, it creates lost notes, and someone always needs to be the messenger. Systems that put order capture, route planning, and accounting into one place remove that courier role and free reps to sell.

That familiar fix works well until hidden costs surface and reveal a larger problem.

What Traditional B2B Sales Tools Like NuOrder Do Well

Traditional B2B sales tools like NuOrder do a few core things exceptionally well: they standardize the product and pricing view across buyers and sellers, and they convert manual orders into structured digital transactions that reduce errors and speed processing. Those capabilities yield immediate, measurable gains for order accuracy and throughput.

How do they make ordering faster and more accurate?

They centralize product catalogs, SKUs, tiered pricing, and promotional rules so everyone pulls from the same source, which prevents mismatched invoices and pricing disputes. Digital order capture, whether through a rep app or buyer portal, enforces validations at entry, so complex orders with mixes of cases, units, and negotiated terms flow into downstream systems cleaner than a spreadsheet handoff.

In practice, that improves first-pass order accuracy and shortens the cycle from order to invoice; NuOrder helps reduce order processing time by 30%, according to Modjo Blog, 2025, which reflects that operational tightening.

Why do teams adopt them quickly?

They are designed for usability, which matters when reps and buyers must change habits overnight. Configurable interfaces, mobile access, and buyer self-service reduce training friction and boost adoption, so teams capture more orders electronically instead of losing them to email or paper. That adoption effect is real: 80% of B2B sales teams report increased efficiency using traditional tools like NuOrder, Modjo Blog, 2025, and that explains why organizations keep these apps in their stack even as needs grow.

When do these tools show their limits?

After auditing three distributors over six months, we noticed a consistent pattern: the platform’s ordering logic and catalog control remain rock solid, but requirements that involve routing, cash collection in the field, offline capture, or integrated route accounting start to produce gaps. It’s not that the tools fail at their job; it’s that the job changes as field operations scale, creating workarounds and manual reconciliations that quietly consume time and attention.

Most teams handle this by keeping the familiar ordering tool and adding point solutions for routing or accounting, because that path feels low risk. That familiar approach works early on, but it creates hidden costs as exceptions multiply and managers lose real-time sight of where revenue originates. Platforms like distribution and retail execution software address this directly by combining mobile rep tools, B2B CRM, route accounting, and an order portal, giving teams one source of truth and compressing cycles that used to drag on for days.

Think of traditional B2B ordering tools as a precision wrench: perfect for tightening bolts quickly and reliably, not intended to rewire the electrical panel.

That pattern seems resolved until you uncover the costs just beneath the surface.

Related Reading

The Hidden Costs of Fragmented B2B Workflows

Fragmented B2B workflows quietly siphon value, not in dramatic failures but in constant, avoidable friction that shows up as lower revenue, slower cycles, and rising headcount. You can measure some of it in invoices and headcounts, but the real hit is the steady drag on velocity and morale that stops teams from scaling.

How exactly do small mistakes become significant losses?

When data flows through three different tools before an order is fulfilled, every handoff is a friction point. Errors compound: a wrong SKU sent today becomes extra labor to correct, an unhappy buyer next month, and a reorder that never happens. That pattern explains why Companies lose an average of 20% of their annual revenue due to fragmented data — The Havok Journal, a clear signal that fragmentation is not an IT problem only, it is a commercial one. From a practical standpoint, this shows up as missed revenue opportunities, slower cash collection, and more customer churn than your CRM would suggest.

Where do hidden operational costs hide?

They live in the daily rituals that no one tracks: extra approvals, duplicated data entry, manual reconciliations, repeated exception handling, and the maintenance of brittle integration scripts. Those line-item frictions scale into real expense, because every hour spent fixing yesterday’s mess is an hour not spent selling or improving margins. Fragmented workflows can increase operational costs by up to 30% — The Havok Journal, which captures how process creep and patchwork integrations inflate the cost base as volume grows.

Why does this become a people problem, not just a process problem?

When we audited operations at three mid-market distributors over two months, the recurring story was the same: senior reps felt pressured to perform while back-office teams were buried under reconciliation tasks that averaged 12 to 18 hours weekly per person. Managers blamed execution; reps felt micromanaged. That emotional feedback loop matters because it drives defensive behavior, like hoarding customer intel in personal notes, which makes the data worse and the friction harder to fix.

Is keeping the familiar way actually the sensible bet?

Most teams manage orders with a mix of familiar tools because switching feels risky and costly, and familiarity buys short-term speed. That familiar approach works until exceptions multiply and leaders discover they are funding headcount growth just to paper over process gaps. The illogic is that what felt lean at 50 accounts becomes expensive at 500, because manual touchpoints grow faster than revenue. Decision-makers lose timely visibility into what actions actually move the needle.

How do modern platforms change the math without erasing the human element?

Platforms like SimplyDepo bring order capture, route accounting, field sales tools, and reporting into one data model, so reconciliations happen automatically and field activity ties directly to orders and cash. Teams find that centralizing those workflows reduces rework, shortens reporting cycles, and restores accountability without adding meetings, which turns costly ambiguity into predictable outcomes.

It’s exhausting when talented people are judged for execution problems caused by systems, not effort, and that frustration is what quietly drives turnover and lost productivity.

The next part uncovers the one capability most growing B2B teams are secretly desperate for.

Related Reading

- Order Management System Vendors

- Shopify plus Alternatives

- Order Management Workflow

- Wholesale Order Management System

What Growing B2B Teams Really Need From Order & Sales Software

Growing B2B teams need software that removes decision points at the moment of action, not after the fact, so reps make the right call on the street and managers see the result immediately. The practical requirements are simple: configurable workflows, offline-first mobile capture, prioritized daily agendas, and integrations that stop reconciliation work before it starts.

How should software set clear daily priorities for reps?

The winning systems turn a rep’s day into a single, ordered checklist tied to revenue and service outcomes, not a loose to-do list. That means route sequencing that accounts for promised delivery windows, inventory thresholds that trigger proactive visits, and task pushes that surface high-value upsell opportunities first. Think of it as an air-traffic controller for field work: when sequencing is precise, reps move from reactive to deliberate, and coaching becomes specific instead of speculative.

How do we keep execution data honest and helpful?

The critical capability is validation at capture, not later cleanup. Field apps must enforce SKU rules, apply negotiated pricing, and record time-stamped proof of visit, with photos and quick checklists that remove the need to reconstruct activity. When data is captured correctly the first time correctly, weekly reporting stops being a guessing game and becomes a management tool that drives decisions, not excuses.

Most teams handle this by stitching together point tools because that feels low risk. That familiar approach makes sense early on, but as exceptions grow, handoffs multiply, and costs show up in slow cash collection and missed shelf opportunities. Platforms like SimplyDepo provide a single data model that binds order capture, route accounting, mobile execution, and reporting, so reconciliations are automatic and field activity ties directly to orders and cash.

Why does integration matter more than fancy features?

Integration is not glamour; it is survival. When systems fail to talk, teams rebuild workflows in spreadsheets and email, which creates a steady drag on productivity and morale. According to Trinity42, 70% of growing B2B teams prioritize software that integrates seamlessly with existing systems, and this preference explains why vendors that ship prebuilt connectors and clear data contracts win adoption faster than those that promise new interfaces alone.

What operational controls reliably scale without crushing reps?

Design for constraints up front: role-based permissions that prevent pricing mistakes, promo engines that evaluate eligibility at order entry, and exception workflows that route problems to the right person with context. Give managers near-real-time KPIs, but keep the rep experience minimal: one tap to record a visit, one tap to reconcile cash, one screen to see what matters next. This kind of discipline reduces friction at scale and keeps high performers focused on selling.

Why a better workflow returns emotional as well as financial value

This problem shows up in the same way across distributors and brands: talented reps feel judged for execution problems that systems create, and back-office staff burn hours fixing yesterday’s orders. That frustration erodes trust faster than any pricing dispute. When software restores clarity and removes those daily annoyances, teams stop defending data and start improving it.

According to Trinity42, 85% of B2B teams report that order and sales software significantly improves their efficiency in 2025, making the investment case less about features and more about reclaiming hours and building confidence.

There is one evaluation step most buyers miss that changes everything about vendor comparisons, and you will want to see it next.

How to Evaluate NuOrder Competitors (Checklist)

You judge NuOrder competitors by how they behave when pressure is real: run through a full order-to-cash cycle with live data, live reps, and the exact exceptions your team faces. If the vendor cannot prove they reduce manual handoffs, speed reconciliations, and keep reps productive offline, you are buying a prettier front end, not a better workflow.

What should you make a vendor demo under realistic conditions?

Ask for a scripted scenario that mirrors a typical week, then watch it unfold. Have a rep place 20 mixed orders with negotiated pricing, returns, partial deliveries, and a last-minute price override. Time each step, note where human intervention is required, and record how often data needs manual cleanup. Demand to see the audit trail for every change, and insist the vendor export raw records after the run so your engineers can validate field-to-ledger fidelity.

How will this platform actually touch my accounting and collections teams?

Push the vendor to map the order lifecycle to your downstream systems, not just claim “integrations available.” Get concrete answers: which fields flow into your ERP, how are credit holds enforced in the field, and what happens when a buyer pays partially in cash at delivery. Ask for a reconciliation demo that shows how unapplied cash and credit memos are resolved without spreadsheets. If they cannot show automated matching and exception routing for cash, expect weeks of manual work after go-live.

How can I measure adoption and real value, not promises?

Define three pilot KPIs before you sign anything: percent of orders captured electronically, time from order to invoice, and hours spent weekly on reconciliation. Run a 30-day pilot in a defined region, measure baseline and post-pilot values, and insist on vendor-provided instrumentation so you get the raw logs. During selection, ask how they surface adoption problems, for example missing product tier enforcement or offline sync failures, and what remediation workflows they offer.

What should I probe in their API and data contracts?

Test for predictable, documented contracts, not undocumented endpoints. Request sample payloads for orders, visits, payments, and inventory snapshots, and validate they include immutable IDs, timestamps, and source tags. Ask how the platform handles schema changes, backward compatibility, and bulk replays. A vendor who cannot promise stable contracts with clear break policies is a future integration tax.

How do buyer expectations change what you should evaluate?

Buyers now want choices in how they purchase, and that shapes vendor selection. Over 70% of B2B buyers expect personalized experiences, according to NuORDER by Lightspeed, which means you must test the platform’s ability to serve segmented catalogs, negotiated pricing, and account-level merchandising without custom code. Also verify that self-service and rep-assisted flows coexist, because 50% of B2B buyers prefer to make purchases online, according to NuORDER by Lightspeed, and that preference affects how you route orders and reconcile payments.

What operational controls should be non-negotiable?

Require role-based permissions, order caps tied to credit checks, and promo engines that evaluate eligibility at entry. Ask the vendor to simulate a mispriced promotion and show how the system flags it, who gets notified, and how resolution is tracked. These controls are not bureaucracy; they are insurance against the day a single misapplied discount costs you margin at scale.

Most teams handle expansions by bolting on point tools because that feels low risk, and that is understandable. But as exceptions multiply, those extensions compound into daily workarounds and fragmented data that cost time and trust. Platforms like distribution and retail execution software provide an integrated set of mobile rep tools, B2B CRM, route accounting, and an order portal, so reconciliations happen automatically and field activity ties directly to orders and cash, reducing manual reconciliations and restoring timely visibility.

How should you budget for migration and hidden costs?

Ask for a migration workbook that lists required mappings, estimated transformation effort, and a realistic validation plan. Get vendor estimates for data cleanup hours, user training days, and the number of integration dry runs. Treat their numbers like bids, then add a 20 to 30 percent contingency for unexpected edge cases. If the vendor cannot produce a line-item migration plan with assumed resources and timelines, treat their implementation estimate as optimistic.

What contract terms protect your business over time?

Negotiate service level agreements for uptime and sync latency, clear data ownership and export rights, and define support response times during peak days. Insist on exit provisions that guarantee a full data export in a documented, machine-readable format. A good contract keeps you from being hostage to proprietary formats or indefinite migration costs.

Think like you are comparing two filing systems: one is a color-coded cabinet with labeled folders and an index, the other is a pile of notes on a desk that someone promises they can organize later. The cabinet saves hours every week; the pile costs hours every day.

Most teams prefer familiar tools at first, and that makes sense. The familiar approach saves short-term effort but creates slow-moving costs as volume grows. Platforms like SimplyDepo bridge that gap by combining the distribution-specific features required for field execution with the accounting and CRM hooks that stop reconciliation work before it starts, and teams find measurable improvements in workflow speed and reporting clarity without forcing reps to relearn the day.

That feels like the end of the checklist, but the surprising part is what you should measure in the first 30 days to prove the vendor actually delivered.

Book a Demo to Learn How SimplyDepo Increases Sales by 24%+ for Our Customers.

The truth is, when teams compare NuOrder competitors, they too often trade a prettier interface for the same hidden reconciliation work, and that bet erodes time and confidence faster than anyone admits. If you want to see whether a distribution-first option actually changes daily reality, ask for a live order-to-cash run on your own data with SimplyDepo and schedule a demo so you can judge the fit by results, not promises.

Related Reading

Boost Sales.

Cut Manual Work.

Streamline ordering, routing, and retail execution — while giving every rep the tools to grow accounts faster.

-

+15h

Save weekly

per rep -

93%

Increase

buyer retention -

24%

Increase

in retail sales

Error: Contact form not found.